I have been blogging way too little recently, so here’s – finally – a bigger one again.

What is a Publisher?

I have recently been asked more and more what the role of a publisher in mobile gaming is today. I mean, heck, there are now even websites proclaiming the (traditional) publishers’ death. On the other hand, venerable old and ruthless new ones are on a spending spree acquiring – seemingly – studios and smaller publishers by the dozen: In the past year or so, EA gobbled up Playfish, Chillingo and Firemint (and probably a few more I don’t know of). Zynga, even hungrier, absorbed XPD Media, Challenge Games, Conduit Labs, Dextrose, Bonfire Studios, Newtoy, Area/Code and Floodgate Entertainment. So what is right?

According to Wikipedia, a videogame publisher is (was?) someone who

publishes video games that they have either developed internally or have had developed by a […] developer. […] They usually finance the development […]. The large video game publishers also distribute the games they publish, while some smaller publishers instead hire distribution companies (or larger video game publishers) to distribute the games they publish.

Other functions usually performed by the publisher include deciding on and paying for any license that a game may utilize; paying for localization; layout, printing and possibly writing of the user manual; and the creation of graphic design elements such as the box design.

Pretty old-school stuff, you say? Erm, yes. Broken down from its beautifully naive pseudo-scientific language, we arrive at the following:

- Publishers pay for development (i.e. absorb the development risk). This could also be classed as project finance.

- Publishers pay for licenses, another case of project finance – unless of course they pretty much own (legally or, through long-term licensing relationships, factually) certain IP.

- Publishers provide a bit of gloss and lots of marketing around a title to help it on the way.

- Publishers – sometimes – distribute.

Is the Same in the Digital Realm?

Now, the Wikipedia definition pretty much focuses on traditional console and PC publishing, it seems (box art anyone?). And this is where the new world sharply departs. No box art, no Walmart or GameStop deals are required if digital distribution is in place. How difficult can it be then for the more modern, more evolved (?) world of digitally distributed and, perhaps (but only perhaps) even more specifically for mobile games?

Nos. 1 and 2 above are pretty much arbitrary parts of the puzzle: you can get money from many places (or not of course) but it is a financing game, and video games could be called a specific (because intrinsically hit-driven) asset class. That is to say, these are not unique attributes.

No. 3 is a combination of money, know-how, experience and network. The more complex the landscape the higher the value of a specialist in the field.

No. 4 is, well, arguably a much easier game when you can feed your distribution channels from your own desk – via the Internet. However, again, the more channels you need to serve, the more complex the landscape, the higher the value of someone "who knows".

Nos. 3 and 4 are – arguably – what made Chillingo (based in the same honest North-West English town as I am) what it is (or, prior to its acquisition by EA, was): Chillingo seems to have had a knack of identifying good or at least decent games and promote them effectively across digital channels. Alas, their biggest hit, Rovio’s Angry Birds had not much good to say about them in terms of support. And indeed, if one looks at what Rovio did with its hit title outside of the Chillingo relationship, one can argue about the value add it had received from its publisher. But then again, Angry Birds seems to have been one of a kind, and there are other titles Chillingo brought to reasonable success that may not have had the same success – be it for lack of a Mighty Eagle such as the fearless and tireless Peter Vesterbacka or otherwise.

Changed Metrics

Chillingo, alas, is not where it’s at, I think. The war is being fought over those (in)famous MAUs – or monthly active users. You see, if you can command those hundreds of millions and parade your own wares by them, the likelihood of your next game becoming a success rises: Digital connectivity solves the dilemma of publishing of old, and that was to attract the attention of the gamer (your customer!) for your next release.

In a box-product world, you had to shout again, and very loudly, in order to have your customer part with his hard-earnd monies for the benefit of your title rather than your competitors’. This is – arguably – why EA Sports sponsors UK football (scil. soccer) broadcasts: "please, God, let people not defect to Konami’s PES from my very own EA FIFA".

Now, Zynga laughs all the way to the bank on this: if you played FarmVille, you will not have come around of realizing that CityVille was out. And you would also get additional points if you also played Zynga Poker. The result? Well, check the top-10 games charts for Facebook games for yourself. Suffice to say that Zynga is – according to the second market – worth more than Electronic Arts… Why is that? Eyeballs, addressable users, dollars spent per acquired user. That the business model is a little different for console games than it is online, doesn’t really matter for the argument here: you can drastically reduce the user acquisition costs if you play it smartly, so no need to take in $39.99 per game in order to break even. $1 or $5 will be just fine, thank you very much.

The above is also the reason for the spending spree of the publishers, I would suggest: if you can buy eyeballs and get a studio with proven skills (just check out either of Newtoy or Firemint on the mobile end), and you can combine it with a mechanism to attract people to future releases, there is a much better chance you can recoup your investment on that future release (effectively de-risking nos. 1 and 2 from the above list).

And now for Mobile!?

Zynga, EA’s Playfish and Crowdstar have shown that you can tweak the fortunes your way if you smartly combine game releases, updates and promotions to work with each other. But how is it for mobile? Backflip Studios, which rose to fame with a simple but well-executed game ("Paper Toss"), claimed to have had racked up more than 2m daily active users and 50m total downloads, mostly driven through promotion of its own titles inside, well, its own titles. Did it have a publisher? No. Does it have a very smart CEO who solved nos. 1 and 2 above and knows how to play no. 3 itself? Yes. So what about no. 4, distribution? Well, on iOS, that is a non-issue: one distribution channel to bind them all. However, on Android, it still falls short of a copycat, "Toss It", who were there earlier, are as ingenious and still rule. And elsewhere? Not much.

But we don’t have to rely on one case alone, and one by a small – though incredibly smart – studio no less. Look at Zynga’s performance on mobile. It is mediocre at best. EA though? Not so bad. What do they do? Well, apply the good old publishing principles learned in the olden world.

And this is where the specific complexities of mobile come into play: mobile is fiendishly complex. On the OS side, there is iOS, Android (in an increasing number of iterations), Windows Phone 7 (with some added spice since the announcement of their Nokia partnership), Blackberry, Samsung’s bada, and then maybe BREW, perhaps still a little bit of Symbian and J2ME. But then there are also the still mighty gatekeepers, the mobile operators. And then you will see that users tend to want to have it their specific way, ideally localized. The plethora of channels thus created makes it tough on a developer to maneuver its way through…

There are tools that can aid progress (and, yes, our very own Scoreloop provides some of them) but it is important to recognize the complexity of it all. Reaching users and convincing them with compelling offers is key to success in any world. It is important to bear that in mind in mobile, too. And if you think you cannot walk it on your own, a publisher might just be the right partner for you.

Changed Weighting

Since 1. and 2. above might not be such a big thing anymore (mobile titles can be developed for less – and, yes, I know this does not necessarily apply to the likes of "Galaxy on Fire" or "Real Racing") and 3. might be manageable but 4. might (not: always is) still be a key reason to part with some share in order to reach the user, convince the user, be able to bill the user.

Every now and again, war breaks out on the web. Or, rather, a full-on discourse of learned scholars on the world at large or, in our case, mobile in particular. This week saw one such blog fights and, no, I am not talking about Wikileaks. The formidable Robert Scoble (he of recent

Every now and again, war breaks out on the web. Or, rather, a full-on discourse of learned scholars on the world at large or, in our case, mobile in particular. This week saw one such blog fights and, no, I am not talking about Wikileaks. The formidable Robert Scoble (he of recent  Scoble first, he, never shy for words, delivered a swift and damning verdict on Nokia: Illustrated ventured Eastwards again to LeWeb last week and took stock of Europe’s smartphone pulse.he reckons that Nokia is dead because none of his friends has one or, if they do, they don’t like it. People pile up in Apple stores and wax lyrical about the apps they find on the iPhone and iPod Touch. Nokia is arrogant rather than cognisant of its shortfalls and he has not recently heard of a strategy. The people (and/or Scoble’s friends) love iPhone. Case closed.

Scoble first, he, never shy for words, delivered a swift and damning verdict on Nokia: Illustrated ventured Eastwards again to LeWeb last week and took stock of Europe’s smartphone pulse.he reckons that Nokia is dead because none of his friends has one or, if they do, they don’t like it. People pile up in Apple stores and wax lyrical about the apps they find on the iPhone and iPod Touch. Nokia is arrogant rather than cognisant of its shortfalls and he has not recently heard of a strategy. The people (and/or Scoble’s friends) love iPhone. Case closed. It’s always a little more difficult to summarise Tomi’s posts as he doesn’t do quick ones. Who knows him is aware that he is a big fan of numbers, of big numbers, in fact. And this is why he hangs on to Nokia: because, you know, their numbers are big! His original post goes – very, very simplified – like this: he sets off to compare Apple with Porsche (as opposed to, say VW). He didn’t reference

It’s always a little more difficult to summarise Tomi’s posts as he doesn’t do quick ones. Who knows him is aware that he is a big fan of numbers, of big numbers, in fact. And this is why he hangs on to Nokia: because, you know, their numbers are big! His original post goes – very, very simplified – like this: he sets off to compare Apple with Porsche (as opposed to, say VW). He didn’t reference  And here’s why (hint: Tomi did get it right but then got carried away on the Finnish ticket): Tomi nailed it in his first post when he compared Apple to Porsche. Apple is not (or not yet?) competing with the Volkswagens and Toyotas of the mobile world. Now: in the automotive world, Porsche failed with the big coup (but, let’s remember, only just!). Apple might yet pull it off. The starting point is not dissimilar: super-high margins, a very comfortable lead in the luxury segment and loads of cash. Porsche over-reached (driven by a perhaps over-zealous ruler). Apple might, well…

And here’s why (hint: Tomi did get it right but then got carried away on the Finnish ticket): Tomi nailed it in his first post when he compared Apple to Porsche. Apple is not (or not yet?) competing with the Volkswagens and Toyotas of the mobile world. Now: in the automotive world, Porsche failed with the big coup (but, let’s remember, only just!). Apple might yet pull it off. The starting point is not dissimilar: super-high margins, a very comfortable lead in the luxury segment and loads of cash. Porsche over-reached (driven by a perhaps over-zealous ruler). Apple might, well… You hear it often (most recently by

You hear it often (most recently by

Recently, previously civilized and subtle top executives of the world’s big mobile handset makers took the gloves off and became, well, a little more outspoken. What sticks from this is, of course, always only the most figurative snippets. Because all of these esteemed people have the most vested of all vested interests, their statements tend to distort reality a little. And because of that, we have increasingly lively debates at hand. But, alas, these debates may not necessarily lead to enlightenment.

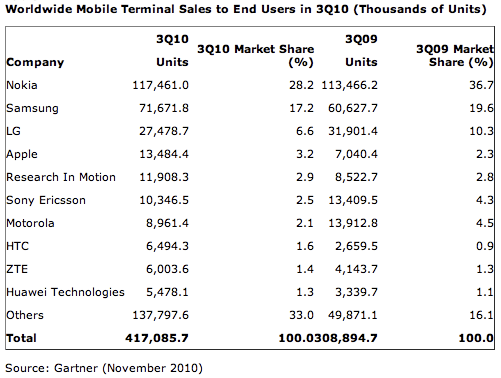

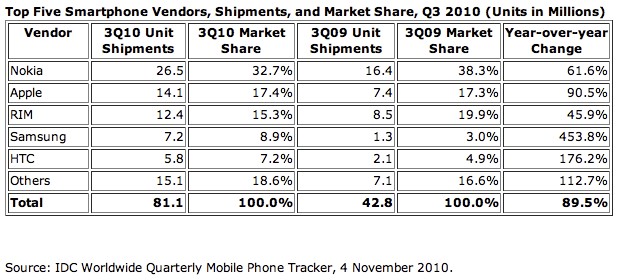

Recently, previously civilized and subtle top executives of the world’s big mobile handset makers took the gloves off and became, well, a little more outspoken. What sticks from this is, of course, always only the most figurative snippets. Because all of these esteemed people have the most vested of all vested interests, their statements tend to distort reality a little. And because of that, we have increasingly lively debates at hand. But, alas, these debates may not necessarily lead to enlightenment. When one looks at the world map and then listens to the good folks cited above (and others), it appears that there is not one but many little worlds out there. Nokia is sitting high and dry in overall handset rankings with over 35% market share across all handsets. It is

When one looks at the world map and then listens to the good folks cited above (and others), it appears that there is not one but many little worlds out there. Nokia is sitting high and dry in overall handset rankings with over 35% market share across all handsets. It is  The situation is a little more serious for other single-segment OEM. RIM used to live off the fat of the land in the enterprise sector. And it continues to thrive there. In recent years, it has seen a huge upswing amongst kids – because of the now almost legendary BBM (Blackberry Messenger for the uninformed). However, can you successfully build or expand on a single feature? And then on one that could really also be mimicked, worked around or substituted by something similar? Tricky.

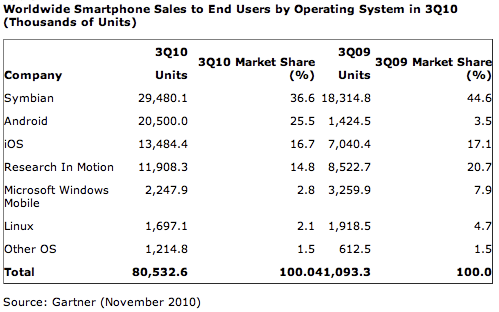

The situation is a little more serious for other single-segment OEM. RIM used to live off the fat of the land in the enterprise sector. And it continues to thrive there. In recent years, it has seen a huge upswing amongst kids – because of the now almost legendary BBM (Blackberry Messenger for the uninformed). However, can you successfully build or expand on a single feature? And then on one that could really also be mimicked, worked around or substituted by something similar? Tricky. All this does of course not bother Android (and perhaps also Microsoft’s Windows Phone 7) as they have the advantage of being able to bringing many weapons to the battlefield. Android’s huge advantage is one of price due to its open-source nature: For Windows Phone 7, you need to pay a software license. Android is – basically – free. Both have multiple OEM that fight their corner though. Which is, or at least can be, good. Google will not really care if the next killer phone is produced by HTC or Motorola or Sony Ericsson (or Foxconn directly for that matter).

All this does of course not bother Android (and perhaps also Microsoft’s Windows Phone 7) as they have the advantage of being able to bringing many weapons to the battlefield. Android’s huge advantage is one of price due to its open-source nature: For Windows Phone 7, you need to pay a software license. Android is – basically – free. Both have multiple OEM that fight their corner though. Which is, or at least can be, good. Google will not really care if the next killer phone is produced by HTC or Motorola or Sony Ericsson (or Foxconn directly for that matter). Does this matter much to Apple? Possibly not. The margin discussion will, in all likelihood, be one that Apple execs will happily take. They will look better at it. However, will it manage to break the old Mac vs. PC pattern? Probably not. However, Apple’s position looks much brighter than it did in the decades of 5% OS-share mediocrity. The company has perfected the hardware-software-service-sex-appeal equation, which looks likely to cement a much more comfortable niche for it (just have a look at its market cap).

Does this matter much to Apple? Possibly not. The margin discussion will, in all likelihood, be one that Apple execs will happily take. They will look better at it. However, will it manage to break the old Mac vs. PC pattern? Probably not. However, Apple’s position looks much brighter than it did in the decades of 5% OS-share mediocrity. The company has perfected the hardware-software-service-sex-appeal equation, which looks likely to cement a much more comfortable niche for it (just have a look at its market cap).