These are my slides from the talk “Capturing Users” I delivered on 30 Nov 2013 at the most excellent StartUp Next conference in Sofia (Bulgaria). For those who were there: the “missing slide” is now included… 😉

Twitter goes public, right? And as of today we know the terms. Those are straight forward and no big surprise: large user base, high growth, huge losses but rising revenues. Alas, on the revenue side, there is probably consent (or at least strong voices) that they need to improve. So just coincidentally, Twitter also announced a few days ago that it struck a deal with CBS about video ads in tweets this autumn (erm, they called it fall, actually). This triggered a discussion on Facebook (yes, my friend Rob was at it again) where people argued if this was a Trojan horse by Twitter to get to those coveted second-screen ad dollars or if it was the natural extension of a movement towards “personal brands” or if it might ring in the death of Twitter as an empowering platform.

What struck me though was this: everyone seems to agree those ads are pesky things that are in your way. No one likes them (I really do not know a single person that has said even once “wow, just my kind of ad, how lovely”). An annoyance. Much worse than billboards or those banner ads we have by now all learned to ignore. Because you have to scroll past them. They can only be compared to the equally annoying video ads on YouTube you can “skip” after X seconds (and, yes, YouTube, we all want to skip them). Without wanting to diminish the significance of Madison Avenue then, I think we can – so far – deduce that the only reason why Twitter makes any money on this is that they can monetize the friction – it’s so annoying and in your way that it will catch some people out. I would love to see measures as to its effectiveness. I would posit that there are a gazillion ways to do it better.

Twitter & Wilshire Boulevard

This got me thinking: they should really be able to do it a lot better, right? I mean, 200m active users, 1bn tweets in every 48-hour period. There’s some money in there, surely. But let’s have a look of what Twitter is. Twitter connects people with each other. It creates a network. A social network. Right? Well, how about this: the road grid of LA connects people with each other. It creates a network. Would you ever call it a social network? Hell, no! And why not? Well, because it’s infrastructure, stupid! Now, ad dollars are being spent plentiful on the streets of LA but no one would ever dream of having them pay for the roads. And that might just be the flaw in all this!

Monetizing Infrastructure

Roads, you see, tend to be “monetized” (financed used to be the word) in one of two ways: tolls or taxes. There are some interesting toll concepts though: In London, the congestion charge (a cool £10 [=$15] charge per day) is being levied whenever you want to drive into the more congested parts of the centre. Makes money! In Germany, only lorries have to pay: commercial use of public infrastructure carries the levy. The Swiss and the Austrians simply run a subscription service. And then you have your distance-driven ones (hello, Italy, France, M6 Toll, etc. etc.). The other way is to treat infrastructure as a public cost to provide an essential service. And because that is a social cost (no, my American friends, no need to run away; this is actually a fairly universally accepted concept), namely one by society, it should be spread across society. And the customarily applied technique to do that is taxes.

Why do we think that roads on the Interwebs can function differently? Mind you, you could probably plaster billboards all over the place and make sure that each neighbouring property onto which those billboards are mounted pays a “viewing charge” (the value of the billboard on that wall has nothing to do with the wall but all to do with Wilshire Blvd. passing by). But – without having run the maths – I am fairly sure that that would not be able to finance the whole thing. The reason why many people think it does work is that it only costs a fraction to build a road grid on the web than it does in real life (all of Twitter’s employees would arguably still be wrestling with that one bypass down in Santa Monica). And that’s really cool! Because it helped many a great technology to come into its own and bring a ton of good to mankind.

Alas, it doesn’t tackle the systemic flaw in the thinking: it is friggin’ infrastructure and that is not really the best way to finance it: annoyance by design? Come on, we should really be doing better. Or can we?

The Value of Networks

Metcalfe’s Law (which I often [ab]use in my talks) states that the value of a telecommunications network is proportionate to the square of its users (he stipulated it to demonstrate the value of ethernet ports). But that doesn’t mean that monetary value of X is Y. Because values can be non-monetary and – sadly (if you’re in the business) – non-monetizable. He would have been more accurate had he replaced the word “value” with “usefulness”.

However, if we home into this then, we might be getting closer to the solution: what it tells us is that Twitter (and every other “social” network) should be aiming to harvest the value it truly brings, namely that of the connections it facilitates. Regular users would most probably scoff at that and move on. However, commercial ones maybe not so much. It would be – crudely comparing this – taking the German toll system to social networks: if you use my infrastructure to transport commercial goods across my said infrastructure, you should pay. Because, you see, you are using my asset to maximize the value of your asset. And because I contribute to this value maximization, I should get a cut. Logical, no?

The value of the commercial use of digital infrastructure is, of course, humongous! On its most basic level, we pay for access (that’s your monthly broadband fees). Twitter (and everyone else in the wider realm) provides a value-add on top of that most basic level, and that is (more or less) meaningful connections. You could liken it to road signs, if you want. And with a network the size of Twitter’s, you’d be lost without them. So there is undoubtedly a lot of value there. But would a regular driver really want to pay for the use of a roadsign? Well, maybe not (even though it would be prudent as it would get her more quickly from A to B). Would a commercial delivery pay for their use? Probably: time is money, dude! And would, say, an ice cream van pay extra if said roadsign could direct him to the road full of ice cream-craving kids who have just had their pocket money? You bet!

This is, of course, what clever algorithms do. Google is pretty nifty with this, I hear. At least when it comes to AdWords and such. The others? Not so much though. The number of completely random, off-target ads and promoted tweets (or, on Facebook, “suggested posts) I have been seeing is mind-boggling. What are they thinking? (no, don’t answer).

To get this right might solve some monetization headaches. It would also do a few more good things: it would leave us regular users in peace! But, even more importantly, it would actually monetize where value is.

Thoughts?

Over everything else that’s been going on today (my resignation from BlackBerry only putting one of the smaller cats amongst my own pidgeons), I nearly missed a rather remarkable deal: Twitter is buying MoPub for – according to unconfirmed sources – $350m in stock. Not too shabby, huh?

Over everything else that’s been going on today (my resignation from BlackBerry only putting one of the smaller cats amongst my own pidgeons), I nearly missed a rather remarkable deal: Twitter is buying MoPub for – according to unconfirmed sources – $350m in stock. Not too shabby, huh?

Why’s that then? Well, we have all been following Twitter’s attempts to turn its growing user base into dollars for (arguably) too long. Their previous (and current) initiatives may have gained somewhat over previous attempts but they still do not really stack up in terms of revenue to what their powerful network (which has famously made regimes tumble down) would suggest it could do.

They have been looking for an ad exchange for a while (the signs were on the wall then) and MoPub looks like a good fit: they are a truly “mobile first” company as was, arguably, Twitter (they have had more mobile usage from Day 1 than most other networks). They run a real-time ad-exchange, meaning the offer of an open space is being created the moment a page loads, an app opens, something happens – in real time (check here for a better explanation). It is basically like Google AdWords for mobile, with the nifty variation that they couple all sorts of mobile inventory and sources into one output. Rather sweet. This of course makes even more sense for Twitter than it might for some other folks as Twitter is “changing” by the second depending on waves of popularity – and, as I said before, a lot of it is on mobile – and it will be more still in the future. So this dynamic nature coupled with the mobile-centric view of MoPub will, I suspect, have been the part that made Twitter part with that much of their stock.

As to this being an all-stock deal (if what TC reports is true): Twitter is probably one of the better pre-IPO stock to hold, I suppose… 😉

Didn’t the world change and quickly? Only a few years ago, mobile games worked like a supermarket: if you have shelf-space, you rule. The early kings of mobile gaming 1.0 (which many users today won’t even know about) were the ones that “owned” the relationships with mobile operators (or carriers if you prefer that word), OEM and the like. Those relationships guaranteed that you would be in front of consumers. Those of your competitors who didn’t? Well, tough luck. Today, the picture is very different. There were a few waves since those early days: the Wild West days of iOS and Android (which didn’t happen simultaneously but with similar patterns), the rise and fall of the Zynga empire (and folks who thought that that approach would cure all [business] evils of gaming and, in its latest pattern, the rise of Supercell, Kabam and King and the scratching of heads (and lay-offs of people) in a lot of other gaming outfits.

So what’s this all about then? Now, I won’t be able to offer you the full Monty in just one small blog post (it’s bloody late already) but there are a few pointers that show both the opportunities but also the pitfalls of the whole thing.

Fun Matters

Ilkka Paananen is the CEO of Supercell who are, arguably, the undisputed money-spinners these days. $2.4m/day is their benchmark, and that was a while back. In Q1/2013, they made $179m in revenues and $109m in operating profits (or so says the FT). Their two (!) games ride comfortably in the top-5 of the top-grossing charts of Apple all around the world, sometimes #1 and #2, sometimes #2 and #4 but never far off… When asked, Ilkka (who is as nice a person as you’ll ever meet) will always tell you that fun is what matters first and foremost (and I reckon this is what young master Pinkus wishes he had known earlier…). Ilkka managed to combine a dream of the free-wheeling nature of the likes of Valve, Inc. with the experience he gained in running as tight a ship as Digital Chocolate who, from the olden days of mobile gaming, were amongst the ones who had perfected the tightly-strung mastery of processes and engines. The result were – now famously – a number of canned projects plus two of the most profitable games (on an ROI basis) produced ever.

Alas, Ilkka will tell you that fun matters. If your game is rubbish and no fun, no one will like it, at least not longer term. Some earlier appstore succresses might have wanted to take note… It is an important bit to remember though: games are part of the entertainment side of things. And entertainment is about fun. No fun = no (long-term) success. There is only so much conning you can do…

Marketing is Part of Design

In the olden days, you had developers and suits. The former had grand ideas and the latter were a pain in the rearside. The success of a game always was due to the former and the success was always claimed by the latter. Now though, even the geekiest of developers has realized that you need to market efficiently if you want to be successful (which also means that your company has a chance of survival). Here’s a post you should read in this respect (it is a bit patronizing but there is a lot of good – if harsh – insight there nonetheless).

Building Brands is Cool (and Hard)

So, let’s go and build a brand, right? Because then we can replicate things, right? I mean, Rovio did this with Angry Birds, right? Yes, they did. How many others do you know who did? Not very many, right? Because, you know, it is not easy. Many tried (and are trying). Many see some traction. None I know of have had counterfeited bobble hats sold in San Francisco so far (yes, there are hand-knitted Angry Birds beanies on sale every weekend at the farmers market at the Ferry Terminal in SF! No, I haven’t seen beanies of the Cut-the-Rope frog yet…).

If you can get it right (and there is some magic (and hard work required), building an entertainment brand is insanely rewarding (just ask Walt Disney, George Lucas, Stan Lee, etc.). However, it is also very hard to do. And it is not for the faint of heart. So think twice… Oh, and hire the right people (two of Rovio’s rockstars just started his own thing in this realm. Go, Andrew!).

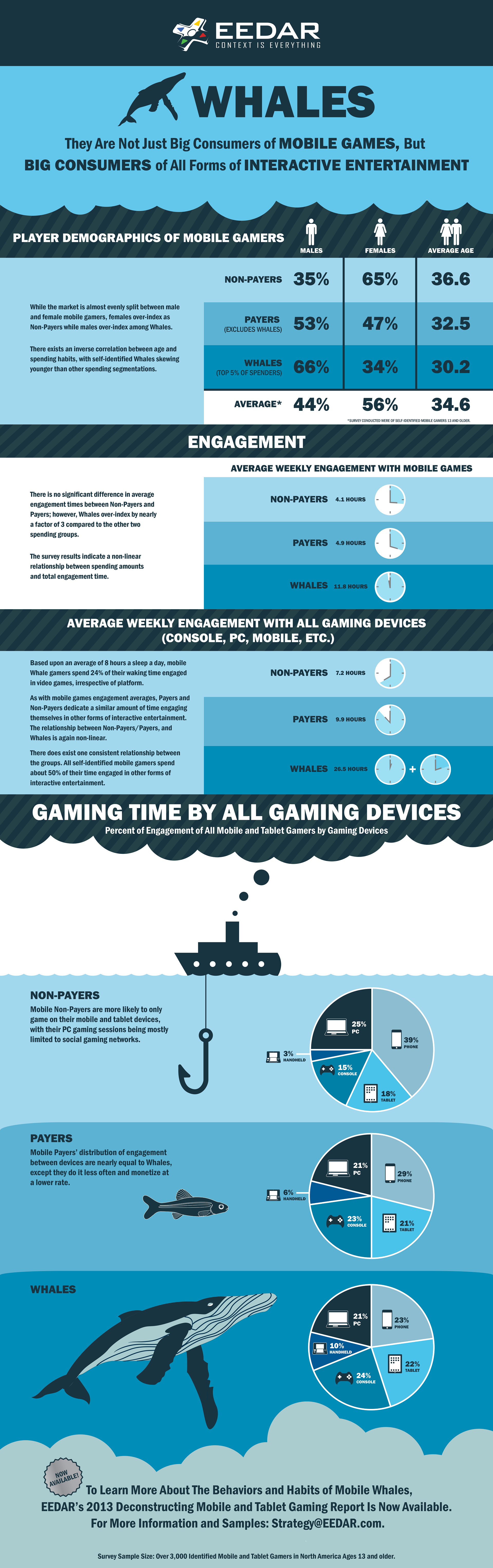

Those Bloody Whales

There was a time when only one-legged near-pirates hunted whales. Nowadays every game developer and their dogs (or cats or rats or pet hedgehogs do). According to Forbes, here’s (well, below) is why. Those are the folks who bring in the money. By my reckoning, the numbers Forbes calls out are not actually the industry benchmark but – perhaps – an averaged out number. This means that, if you’re good at what you do, you should be pulling in a lot more than what their article has you believe you should. And that is something that can be a little daunting. So, kids, there goes your easy career in game development…

Before I link to this Forbes thing then: it is not easy, mind the fun, get some kudos to them suits and be in for the ride… 😉

Here’s the Forbes article (from which I copied the infographic below and where you can get the fully scalable version).

Here’s something cool, a mobile accelerator run by people who actually know mobile, namely the good folks from Mobile Monday (disclosure: I am a co-founder of Mobile Monday Manchester). For those who don’t know (and I don’t expect many of the readers of this blog to being that ignorant… 😉 ): Mobile Monday has a global presence in over 140 cities across 50 different countries. As part of Mobile Monday, participants will get greater global exposure with leading brands to help foster business relationships and potentially commercial deals. It works, believe me!

This is a 12-week program (from 23 September – 6 December), run at RocketSpace in Silicon Valley with the aim to help accelerate mobile startups. They will select 8-10 startups from around the globe to participate in each class. If you are not based in the Bay Area, you’d have to cover your own housing and living though (which they say should amount to $2,500/month; also: you need to sort out your own visa should you need one though they’ll help you).

The program is designed for startup founders. It consists of weekly workshops and dinners lead by leaders of “global brands” who will help mentor and work closely with participating companies. You will have the opportunity to pitch their “dedicated” team of VCs and angels. The program will end with a Demo Day attended by industry leaders, VCs, and the press. So it’s pretty much the usual stuff. However, it being run by the MoMo folks, you can probably expect a rather good pick from the mobile world!

Here are the minimum criteria (and you will see from this that you actually have to have something already; this is an accelerator, not an incubator):

Each application will be scored on five criteria:

All Mobile Monday Accelerator events will be held in the San Francisco bay area. Office space at the RocketSpace Innovation Campus (San Francisco downtown) is provided free to all accelerator class participants. RocketSpace is home to Fortune 500s like, T-Mobile, GM, DoCoMo, Microsoft, ABInBev, LEGO and to 150+ startups including Spotify, Supercell and HasOffers (yup, that is straight from their sales pitch).

The program currently provides 50+ of the best in mobile mentors; Samsung, Sony, Twitter, Facebook, AOL, ESPN, Polariod, PayPal, Intuit, The Weather Channel, Hotel Tonight, Millenial Media and more… (yup, again from their pitch)

Each week, they’ll host a workshop in the San Francisco bay area at our offices or a partner’s office on the usual topics like:

If you want to get into this (and, hey, it is just about the time when the weather in certain areas get somewhat yucky), you can apply here. Good luck!

So here’s the mother of all IPOs then, and it was coming a long way. The web was buzzing, today analysts of any couleur are commenting and reading through the fine print of Facebook’s registration statement (known as the S-1) in order to find valuable nuggets of information that they had not had before and myriads of bloggers and journalists drool over the new wave of young wealthy people in the Valley.

So here’s the mother of all IPOs then, and it was coming a long way. The web was buzzing, today analysts of any couleur are commenting and reading through the fine print of Facebook’s registration statement (known as the S-1) in order to find valuable nuggets of information that they had not had before and myriads of bloggers and journalists drool over the new wave of young wealthy people in the Valley.

No mobile revenue

Whilst I’d love to join into this frenzy, I want to focus on one point in the S-1 that caught my eye, and which might pose some interesting challenges for the social networking giant going forward, namely the large abyss between mobile use of the site and revenues derived from it. You will likely have read about the huge amount of Facebook users regularly using the site from mobile devices. According to the company itself, 425m active users (out of a user base of 845m) accessed the site using mobile devices; that’s more than 50%. And yet, Facebook does not derive “any meaningful revenue” (quote from their S-1) from it.

Why (these) ads don’t work as well

This is, of course, because it – thus far – did not find a good way to display ads in their various guises to mobile users. The screen real estate is scarce and it would be easy to destroy the user experience by doing so. However, with that growth in usage, they may have to review this approach. The challenge is then to successfully marry user experience on a small(er) screen with revenue-generating activities. And, alas, the latter are so far mainly display ads of various sorts. How successful will those be? My guess is not very much. It is likely one reason why Facebook so far has shied away from using them: it might just destroy the user experience to an extent that its users would be seriously upset.

And yet, it is only the latest case of highlighting one of the common fallacies of migration from web to mobile (and I am not even saying they are wrong to move that way; their user growth and occuption of that space will likely counter-balance that; I think it was Accel’s Rich Wong who said that it is easier to find revenue streams once you have 100’s of millions of users than to find 100’s of millions of users with a (pre-)defined revenue stream). Nevertheless, none of us would watch a TV commercial showing you a static picture and someone reading something out from the off (this is exactly how TV advertising kicked off). We were not overly thrilled by early attempts of online advertising; they were merely an attempt to convert billboards and printed circulars to the digital realm. It was not until Google’s AdWords that online advertising really hit it off. So why would we now be content with a mere port from another form of media?

The Japanese way?

Japan has shown that there are other ways. Japan’s GREE reportedly records similar revenues from about 5% the user base than Facebook does. It does so mainly with virtual currencies and goods (and, yes, it has moved to a slightly different target market); users can customize their experiences within that social network by buying “stuff” to embellish their avatars, play, use, customize content, etc. Japan has always been something of the Galapagos Islands when it comes to mobile usage: what worked there didn’t often work elsewhere (anyone remember i-mode?). However, we are seeing a similar effect on smartphone applications: 65% of the top-grossing apps these days use some sort of “freemium” feature. This approach might be too late for Facebook now though. Its users would be up in arms would they start charging for features that users have come to see as free.

I am fairly confident that the good folks of Facebook are here to stay but I am still thrilled to see if, when and how they will begin to adapt. With all the very smart people in the company, we may just see the next wave of mobile monetization, and I wonder what it might be…

This week’s Carnival of the Mobilists comes to you from Kansas, more specifically from Steven Hoober, and here’s what he has in stock for you:

The carnival is live here. Go read! 🙂

Powered by WordPress & Theme by Anders Norén