According to a recent report, Android has zoomed past Apple in US smartphone OS share, taking the #2 spot with 28% behind Blackberry (36%) but now ahead of Apple iPhone OS with 21% (and, yes, I know that Apple somewhat lamely queried the accuracy of this). Be it as it is, Android is growing (and we all knew that, did we not?). According to Google’s CEO, Eric Schmidt, the company now sees 65,000 new phones being activated per day; this equates to a run rate of 23.7m for the year.

According to a recent report, Android has zoomed past Apple in US smartphone OS share, taking the #2 spot with 28% behind Blackberry (36%) but now ahead of Apple iPhone OS with 21% (and, yes, I know that Apple somewhat lamely queried the accuracy of this). Be it as it is, Android is growing (and we all knew that, did we not?). According to Google’s CEO, Eric Schmidt, the company now sees 65,000 new phones being activated per day; this equates to a run rate of 23.7m for the year.

This is good news for handset manufacturers like HTC, Motorola and Samsung (all of who are shipping successful Android devices) as well as Google (which is fairly tightly embedded in the whole thing) but does it also reflect on the wider ecosystem of developers producing applications and services for the platform?

The main points that are usually mentioned are:

- Low overall numbers: Digital Chocolate’s CEO Trip Hawkins moaned the company sold less than 5,000 units of its hit game “Tower Bloxx” on Android Market, which was indicative for the lack of uptake. If that is so overall, may remain to be seen. I beg to take into a account that Android as a platform is fairly new and the overall install base is still smaller than its competitors.

- High price-sensitivity: according to an AdMob survey in January 2010, 12.6% of Android apps are paid vs. 20.4% on iPhone OS; the same survey revealed however that the average monthly spend was actually similar on Android ($8.36) and iPhone ($8.18) though higher on iPod Touch, which runs the iPhone OS, too ($11.39).

- Return policy: Google allows users to return an app for a full refund within 24 hours of purchase. This is seen particularly onerous for games (a lot of which can be played start to finish inside that time frame).

- Discovery: developers feel Google fell well short of Apple on this one. There is no possibility to discover apps from outside a mobile device (i.e. no iTunes) and Google has not really done anything in terms of marketing either (very much unlike Apple).

- Ease of purchase: I would like to add ease of use of the buying process. Registration with Google Checkout is a far, far cry from setting up an iTunes account. This will very likely change very, very soon as Google will add carrier-billing now that it decided to move distribution of its branded Google Nexus One from D2C web-only distribution to the usual carrier model.

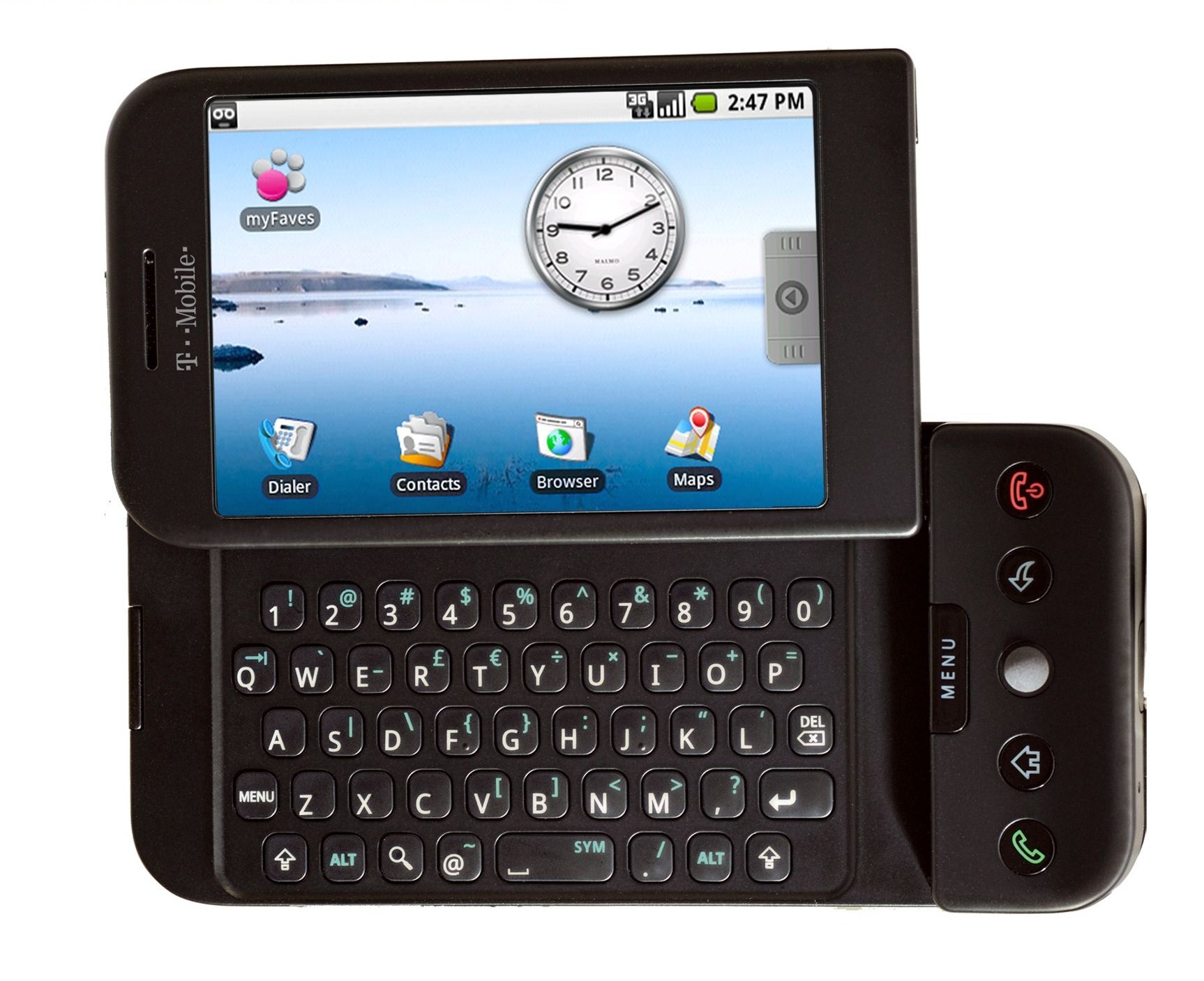

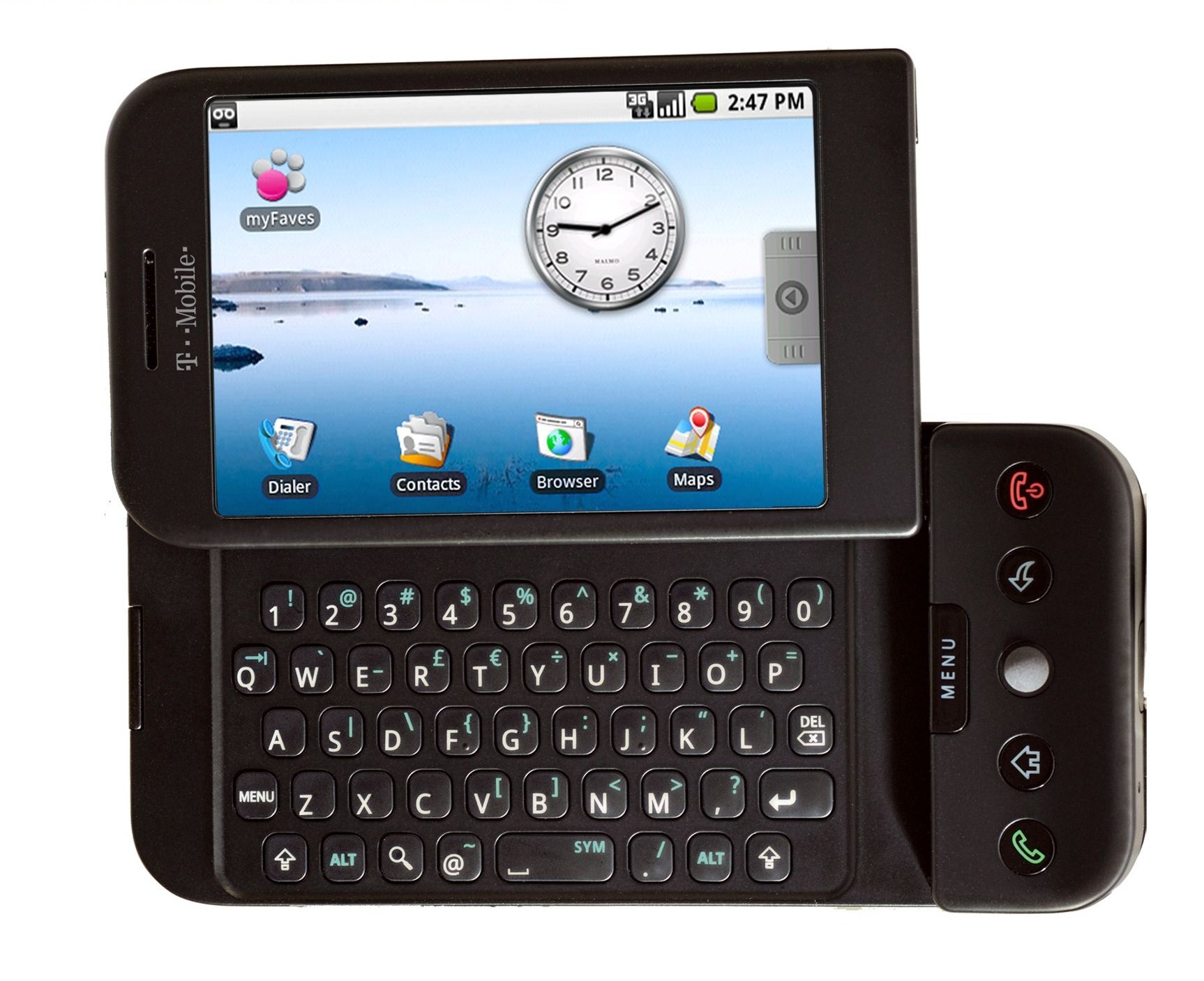

So what about it? Let us not forget how young Android is – even compared to the adolescent iPhone. The platform launched from an install-base of zero some 18 months ago, with the HTC G1 being the only device out there – and available through a single US carrier, T-Mobile (with a market share around 12%). Whilst I do not want to take anything away from Apple’s superior accomplishments with the iPhone, the growth of Android is not too shabby either! And with a plethora of manufacturers deploying Android-based handsets now (cf. the growth numbers above), Android is likely to be powering into the fore even more (irrespective of whether or not the above stats on it overtaking iPhone OS in the US already being true).

So what about it? Let us not forget how young Android is – even compared to the adolescent iPhone. The platform launched from an install-base of zero some 18 months ago, with the HTC G1 being the only device out there – and available through a single US carrier, T-Mobile (with a market share around 12%). Whilst I do not want to take anything away from Apple’s superior accomplishments with the iPhone, the growth of Android is not too shabby either! And with a plethora of manufacturers deploying Android-based handsets now (cf. the growth numbers above), Android is likely to be powering into the fore even more (irrespective of whether or not the above stats on it overtaking iPhone OS in the US already being true).

Price-sensitivity is not actually as bad as people think: the aforementioned AdMob survey shows nigh identical average spending patterns. Personal impressions may again be hampered with by early experiences: be reminded that, initially, there were only free apps out there. They will surely still be hanging around, but will they also for much longer?

Apple has always been extremely scrupulous on approval of applications on its platform. And whilst this may now be held against it every now and then (e.g. in the case of nipples or Pulitzer-price-winning political cartoons), it has helped it to uphold a fairly high standard of quality, which Android was lacking (initially) and which even led to “crap-filter” apps. One can however safely assume that this will change once the market size improves: Apple’s margins might be superior to everyone else in the world but that does not mean that the margins game developers can achieve with it are the same. With Android OS primed to expand at a much faster pace, the numbers will clearly speak for it, and – I would posit – that will bring more and more quality to the store, with the fads sinking fast.

Also, do not forget the big brands: they do not necessarily care for a small share of the audience only. Whilst Android was fledgling and just starting up, they may have held back but, ultimately, they are about reach, and Android is certainly bound to deliver that. I would therefore suggest that we will be seeing an influx of large brands (gaming and otherwise) onto the Android platform very soon, and this will also help user orientation as to what to go for and what not.

Also, do not forget the big brands: they do not necessarily care for a small share of the audience only. Whilst Android was fledgling and just starting up, they may have held back but, ultimately, they are about reach, and Android is certainly bound to deliver that. I would therefore suggest that we will be seeing an influx of large brands (gaming and otherwise) onto the Android platform very soon, and this will also help user orientation as to what to go for and what not.

The discovery of apps will also be helped by the more open nature of Android. There have been a number of announcement for curated stores by carriers (e.g. Vodafone, Orange, Verizon Wireless, Sprint, etc.), and these will certainly not be allowing a free for all! Besides that, the app store model does per se pose some challenges on developers: the more successful a platform (and/or store) is, the harder it is to be discovered. One might need to look for other solutions in that respect…

The billing side of things is bound to improve, too. With carrier-billing around the corner (cf. supra), this will get easier and better. And also easier and better than it is on the iPhone: charges will simply appear on your carrier bill (smart pipe anyone?). Besides that, the business models for games are undergoing significant changes anyhow: Freemium takes centre-stage, and so it should: the model allows people to try a game out and be charged for it only when they know that a) they like it, b) what they are being charged for (e.g. that coveted sword, a couple of precious lives, or that cool background theme).

The billing side of things is bound to improve, too. With carrier-billing around the corner (cf. supra), this will get easier and better. And also easier and better than it is on the iPhone: charges will simply appear on your carrier bill (smart pipe anyone?). Besides that, the business models for games are undergoing significant changes anyhow: Freemium takes centre-stage, and so it should: the model allows people to try a game out and be charged for it only when they know that a) they like it, b) what they are being charged for (e.g. that coveted sword, a couple of precious lives, or that cool background theme).

Remains the return policy. I have been raising this with Google, and it must be pointed out that similar things exist on the iPhone (they’re just “better” hidden). So besides the obvious (Google’s good intentions came back to haunt them), it is also time to think of new business models (cf. Freemium). It is not something constrained to Android: transparency requires you to deliver value. If you do, there are good and transparent means to monetize that value; and users will follow.

So, yes, there is game in Android. If you don’t believe it now, just wait for it! 😉

Last week, I moderated a panel at

Last week, I moderated a panel at  An example: a couple of years ago, we shipped a whole suite of X-Men 3 content, game, wallpapers, tones, you name it. The launch was, of course, around the movie launch (which was tremendously successful) and we had carefully crafted marketing plans including many brand partners (20th Century Fox, Activision, Panini, etc). We managed to drive some exceptional campaigns to which carriers in a lot of countries contributed serious marketing dollars. Did they do this in order to obtain an SMS-margin-matching ROI? Not in the strict sense. To them, this was brand extension and affiliation. And, boy, did it work!

An example: a couple of years ago, we shipped a whole suite of X-Men 3 content, game, wallpapers, tones, you name it. The launch was, of course, around the movie launch (which was tremendously successful) and we had carefully crafted marketing plans including many brand partners (20th Century Fox, Activision, Panini, etc). We managed to drive some exceptional campaigns to which carriers in a lot of countries contributed serious marketing dollars. Did they do this in order to obtain an SMS-margin-matching ROI? Not in the strict sense. To them, this was brand extension and affiliation. And, boy, did it work! I stumbled across an

I stumbled across an  According to a recent

According to a recent  So what about it? Let us not forget how young Android is – even compared to the adolescent iPhone. The

So what about it? Let us not forget how young Android is – even compared to the adolescent iPhone. The  Also, do not forget the big brands: they do not necessarily care for a small share of the audience only. Whilst Android was fledgling and just starting up, they may have held back but, ultimately, they are about reach, and Android is certainly bound to deliver that. I would therefore suggest that we will be seeing an influx of large brands (gaming and otherwise) onto the Android platform very soon, and this will also help user orientation as to what to go for and what not.

Also, do not forget the big brands: they do not necessarily care for a small share of the audience only. Whilst Android was fledgling and just starting up, they may have held back but, ultimately, they are about reach, and Android is certainly bound to deliver that. I would therefore suggest that we will be seeing an influx of large brands (gaming and otherwise) onto the Android platform very soon, and this will also help user orientation as to what to go for and what not. The billing side of things is bound to improve, too. With carrier-billing around the corner (cf. supra), this will get easier and better. And also easier and better than it is on the iPhone: charges will simply appear on your carrier bill (smart pipe anyone?). Besides that, the business models for games are undergoing significant changes anyhow: Freemium takes centre-stage, and so it should: the model allows people to try a game out and be charged for it only when they know that a) they like it, b) what they are being charged for (e.g. that coveted sword, a couple of precious lives, or that cool background theme).

The billing side of things is bound to improve, too. With carrier-billing around the corner (cf. supra), this will get easier and better. And also easier and better than it is on the iPhone: charges will simply appear on your carrier bill (smart pipe anyone?). Besides that, the business models for games are undergoing significant changes anyhow: Freemium takes centre-stage, and so it should: the model allows people to try a game out and be charged for it only when they know that a) they like it, b) what they are being charged for (e.g. that coveted sword, a couple of precious lives, or that cool background theme).