Egoblogger extraordinaire Robert Scoble has never been known to be shy, and so he declared with his usual great fanfare that Europe did not matter any more in terms of mobile innovation. Why did he say that, you ask? Well, Nokia apparently took him to visit their research lab in Cambridge (no, not in Espoo) as part of a (Nokia-)sponsored geek tour. And Scoble was not impressed. Because (1) everyone appears to have been texting when he was on the tube (how quaint), (2) the N97 isn’t cooler than the iPhone and (3) Symbian is much clunkier than the iPhone’s OS or Palm’s WebOS, Scoble deduces that Europe has had it.

He reduces this loss of leadership in mobile innovation to handsets or, more specifically, to the coolness factor of handsets (“London’s cool kids are [not] hot and bothered” about the N97). And, with that somewhat tight limitation, he might actually be right. Nokia has been losing ground on the coolness and usability front for quite a while. However, when it comes to technical ability, their devices are still quite hot. Scoble basically uses the iPhone plus the first Android-based (Taiwanese [sic!]) phones to declare that the king is dead.

Hardware is a Commodity

Now, let’s try to differentiate a little. Would you say the US have the lead in computer manufacturing? Well, probably not. IBM’s ThinkPads are Chinese, then there is Sony, Samsung, Toshiba, and there is HP and Dell. There is of course also Apple (“designed in California”). Does it matter at all where the hardware is from? No, not at all, and no one really cares anymore. And why not? Because hardware is basically a commodity, that is in a world where one does not actually see that much of the hardware because the interfaces are software-driven. And these are from Microsoft, etc.

Now, let’s try to differentiate a little. Would you say the US have the lead in computer manufacturing? Well, probably not. IBM’s ThinkPads are Chinese, then there is Sony, Samsung, Toshiba, and there is HP and Dell. There is of course also Apple (“designed in California”). Does it matter at all where the hardware is from? No, not at all, and no one really cares anymore. And why not? Because hardware is basically a commodity, that is in a world where one does not actually see that much of the hardware because the interfaces are software-driven. And these are from Microsoft, etc.

In mobile, this has not been true in the past because their were such vast differences in the available hardware that the usability was severely impaired should you have been using, say, a low-end Motorola device as opposed to a high-end Nokia. This is where the myth of European mobile superiority comes from. And, with Apple, RIM and maybe Palm again, this is firmly in North American hands. There are of course Samsung and LG, the Korean powerhouses who drive their market share up and up. Android devices G1, G2 and Magic are from Taiwanese HTC. However, given how far mobile software and indeed services have come: does it really matter either way today? I say it does not.

Here’s the Innovation: Services

If one wants to see where mobile innovation is happening, one would need to go to South Korea, Japan, Finland (not the Nokia research labs but, say, the public transport system where you can pay via SMS for the past couple of years already), Austria (mass deployment of mobile RFID-payments), South Africa (mobile wallets and very evolved mobile marketing services), Malaysia, the Philippines and even Kenya (mobile money transfers). Certainly not the US though, I’m afraid. They are still the country where “can you hear me now?” campaigns rule.

The iPhone has changed a lot of things of course. However, American Idol arguably did a lot more. It brought, shock, horror, texting to the Americans. SMS being, of course, a service. And why, Mr Scoble, should that be bad? Carriers (other than in the US) have made 25% of their revenues and 50% of their profits over the last 10 years with this unassuming little thing. That’s not too shabby, is it? The iPhone (and Palm’s WebOS) have introduced a new level of ease of use, and one that was long overdue. One that woke Nokia, which had comfortably dominated the space with less and less innovation on the software side, up (and Nokia might be a little slow to open their eyes properly). And one that will improve service levels all over the world.

The iPhone has changed a lot of things of course. However, American Idol arguably did a lot more. It brought, shock, horror, texting to the Americans. SMS being, of course, a service. And why, Mr Scoble, should that be bad? Carriers (other than in the US) have made 25% of their revenues and 50% of their profits over the last 10 years with this unassuming little thing. That’s not too shabby, is it? The iPhone (and Palm’s WebOS) have introduced a new level of ease of use, and one that was long overdue. One that woke Nokia, which had comfortably dominated the space with less and less innovation on the software side, up (and Nokia might be a little slow to open their eyes properly). And one that will improve service levels all over the world.

Where the Big Market is

However, let us also not forget that the best-selling phone of all times is the Nokia 1100. No, it doesn’t do Java. It has a battery life of close to 20 years though and comes with a flashlight installed. Both very handy things to have in rural parts of developing or emerging countries. Nokia is having a fairly comfortable market share in these countries. I am not sure if that is a good thing to rest on though: as these markets, they demand more sophisticated devices. And because the computer penetration is much lower than in Europe, Japan, South Korea and North America, the significance of evolved mobile devices will be even more important. Nokia thought this would carry it through. However, we are seeing now that that might not be so: its smartphone market shares are rapidly decreasing.

Europe is not Europe

One last word on Europe: distinct to what Mr Scoble appears to have in mind, Europe is not a country, and this is not meant to be sarcastic. Europe is a pile of little countries and in each of them a couple of carriers rule like little kings. It makes for an extremely complex (and, consequently, low-margin) playground to deploy services. The US (as well as some of the huge Asian countries) have the incredible opportunity to deploy applications and services in one language through less than a handful of carriers to hundreds of millions. No such thing in Europe.

One last word on Europe: distinct to what Mr Scoble appears to have in mind, Europe is not a country, and this is not meant to be sarcastic. Europe is a pile of little countries and in each of them a couple of carriers rule like little kings. It makes for an extremely complex (and, consequently, low-margin) playground to deploy services. The US (as well as some of the huge Asian countries) have the incredible opportunity to deploy applications and services in one language through less than a handful of carriers to hundreds of millions. No such thing in Europe.

And this is why the US should lead in every aspect really: it is an evolved, competitive economy and it enjoys the tremendous upside of being (almost) completely aligned as to the framework: language, currency, carriers, billing systems, legal system, etc. This is the reason why the US has indeed leapfrogged Europe, the continent, when it comes to basic mobile applications: economies of scale are much easier to achieve there.

Software, Services, Interfaces

When one looks at Nokia in its current state as the sole indicator of where European mobile innovation is, one might be disappointed (as I pointed out numerous times, e.g. here). However, when one looks at how concert tickets are being sold via mobile, public transport, parking fees and vending machines all using mobile as a wallet solution, or indeed Obama making his latest speech available via SMS (there are more than 10x as many mobile phones in Africa than PCs according to Tomi Ahonen), then one can and should still be awed. And, no, in spite of its President the US is not (yet) close in this respect.

I hope, however, the US will catch up on this front sooner rather than later, too. Because of the size of the market and the aforementioned advantages, it would unleash incredible opportunities that would bring all of us fantastic new services and applications. And, Mr Scoble, it does not matter if these are 160 characters or polished web pages; it depends on what you want to do with it (as you, being one of the most prolific Twitterati, surely know).

I hope, however, the US will catch up on this front sooner rather than later, too. Because of the size of the market and the aforementioned advantages, it would unleash incredible opportunities that would bring all of us fantastic new services and applications. And, Mr Scoble, it does not matter if these are 160 characters or polished web pages; it depends on what you want to do with it (as you, being one of the most prolific Twitterati, surely know).

I did not text anymore because I hated the UI and could not stand the clunky interfaces (in spite of T9; I’m too old, I guess). I started again with the iPhone. Why? Because – distinct what some people say – it’s a great interface: it displays the conversation, it looks neat and I have a full keyboard (the touch screen works much better than I feared; and I used a Blackberry for years and years). But that is not a question of the device or the technology, it is solely a question of the software. I would be much happier if I could also use my iPhone (or any other phone) to buy my newspaper (which I can with an RFID-equipped credit card in this country and which I could do in, say, Austria, a country with 2/3 the population of Illinois and a footprint smaller than Maine).

What Scoble misses (or omits in his post) is that the next leap in innovation will be a service-driven one (just as we saw on the Internet: first hardware, then basic apps, now sophisticated services).

Mobile has had the hardware phase, it is going through a “basic” app phase, and some European, African and Asian countries have entered the value-added services phase already, some years and years ago in fact! Compared to the US, they’re leading, by a lot! They’re perhaps just too small for the Robert Scoble to realize they’re there… But, as I said above: this is not about Europe leading the US (apart from the fact that it would appear to being Asia that is truly leading and has been for a while): it is about the evolution of an incredibly powerful communication device that is being unlocked for more and more applications and services; and this is independent from country and nationality!

Along those lines: why, Mr Scoble, should it be a bad thing that Europeans now “must” visit Cupertino and Mountain View. California is nice, isn’t it? Not a bad thing to go visit every now and then at all! We’re living in a large world, Mr Scoble, not only on a single continent, and mobile is a facilitator spurning new ecosystems, not only a device.

Image credit drawing: http://www.aartkom.cz

Recently, previously civilized and subtle top executives of the world’s big mobile handset makers took the gloves off and became, well, a little more outspoken. What sticks from this is, of course, always only the most figurative snippets. Because all of these esteemed people have the most vested of all vested interests, their statements tend to distort reality a little. And because of that, we have increasingly lively debates at hand. But, alas, these debates may not necessarily lead to enlightenment.

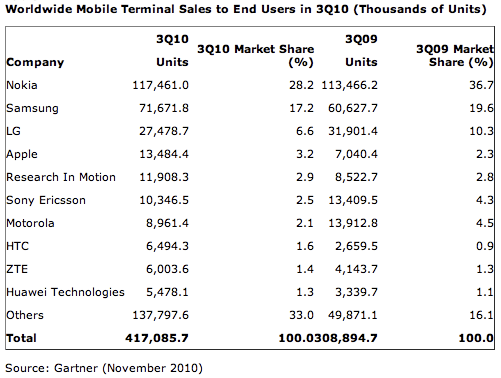

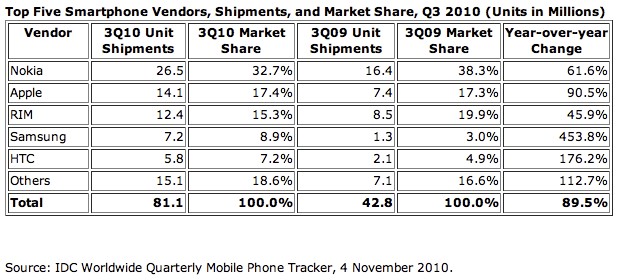

Recently, previously civilized and subtle top executives of the world’s big mobile handset makers took the gloves off and became, well, a little more outspoken. What sticks from this is, of course, always only the most figurative snippets. Because all of these esteemed people have the most vested of all vested interests, their statements tend to distort reality a little. And because of that, we have increasingly lively debates at hand. But, alas, these debates may not necessarily lead to enlightenment. When one looks at the world map and then listens to the good folks cited above (and others), it appears that there is not one but many little worlds out there. Nokia is sitting high and dry in overall handset rankings with over 35% market share across all handsets. It is

When one looks at the world map and then listens to the good folks cited above (and others), it appears that there is not one but many little worlds out there. Nokia is sitting high and dry in overall handset rankings with over 35% market share across all handsets. It is  The situation is a little more serious for other single-segment OEM. RIM used to live off the fat of the land in the enterprise sector. And it continues to thrive there. In recent years, it has seen a huge upswing amongst kids – because of the now almost legendary BBM (Blackberry Messenger for the uninformed). However, can you successfully build or expand on a single feature? And then on one that could really also be mimicked, worked around or substituted by something similar? Tricky.

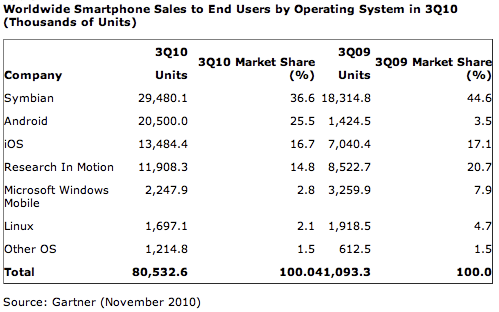

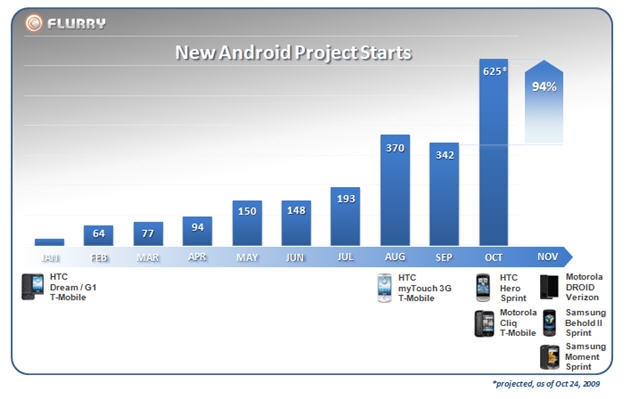

The situation is a little more serious for other single-segment OEM. RIM used to live off the fat of the land in the enterprise sector. And it continues to thrive there. In recent years, it has seen a huge upswing amongst kids – because of the now almost legendary BBM (Blackberry Messenger for the uninformed). However, can you successfully build or expand on a single feature? And then on one that could really also be mimicked, worked around or substituted by something similar? Tricky. All this does of course not bother Android (and perhaps also Microsoft’s Windows Phone 7) as they have the advantage of being able to bringing many weapons to the battlefield. Android’s huge advantage is one of price due to its open-source nature: For Windows Phone 7, you need to pay a software license. Android is – basically – free. Both have multiple OEM that fight their corner though. Which is, or at least can be, good. Google will not really care if the next killer phone is produced by HTC or Motorola or Sony Ericsson (or Foxconn directly for that matter).

All this does of course not bother Android (and perhaps also Microsoft’s Windows Phone 7) as they have the advantage of being able to bringing many weapons to the battlefield. Android’s huge advantage is one of price due to its open-source nature: For Windows Phone 7, you need to pay a software license. Android is – basically – free. Both have multiple OEM that fight their corner though. Which is, or at least can be, good. Google will not really care if the next killer phone is produced by HTC or Motorola or Sony Ericsson (or Foxconn directly for that matter). Does this matter much to Apple? Possibly not. The margin discussion will, in all likelihood, be one that Apple execs will happily take. They will look better at it. However, will it manage to break the old Mac vs. PC pattern? Probably not. However, Apple’s position looks much brighter than it did in the decades of 5% OS-share mediocrity. The company has perfected the hardware-software-service-sex-appeal equation, which looks likely to cement a much more comfortable niche for it (just have a look at its market cap).

Does this matter much to Apple? Possibly not. The margin discussion will, in all likelihood, be one that Apple execs will happily take. They will look better at it. However, will it manage to break the old Mac vs. PC pattern? Probably not. However, Apple’s position looks much brighter than it did in the decades of 5% OS-share mediocrity. The company has perfected the hardware-software-service-sex-appeal equation, which looks likely to cement a much more comfortable niche for it (just have a look at its market cap). A couple of weeks ago, I gave a keynote at

A couple of weeks ago, I gave a keynote at  The ecosystem is tough to address as every mobile game developer will tell you. Which is why the iPhone was such a huge game changer: one device on one platform with one distribution channel globally. And all presented well, easy to use, great UI and users get to content with very few clicks and without unnecessary warnings). It is also always connected (rather than only connected in theory) and hence opens the doors to a new way of consuming, promoting and using content, specifically interactive one such as games and apps. Everyone else scrambles to follow but they struggle because it is such a different way to look at the world (well, different when you are a network operator or handset OEM). And because of this, competition on this platform is now fierce, very fierce.

The ecosystem is tough to address as every mobile game developer will tell you. Which is why the iPhone was such a huge game changer: one device on one platform with one distribution channel globally. And all presented well, easy to use, great UI and users get to content with very few clicks and without unnecessary warnings). It is also always connected (rather than only connected in theory) and hence opens the doors to a new way of consuming, promoting and using content, specifically interactive one such as games and apps. Everyone else scrambles to follow but they struggle because it is such a different way to look at the world (well, different when you are a network operator or handset OEM). And because of this, competition on this platform is now fierce, very fierce. Do not forget: people (and brands) want to reach people. Full stop. They do not necessarily want to reach people who happen to have an XYZ device running the ABC OS on the carrier X in country Y! Apple is wonderful (I am an avid iPhone user and do not plan to change – well, yet) but it is a niche. And if you have business to do, you may want to look beyond that niche.

Do not forget: people (and brands) want to reach people. Full stop. They do not necessarily want to reach people who happen to have an XYZ device running the ABC OS on the carrier X in country Y! Apple is wonderful (I am an avid iPhone user and do not plan to change – well, yet) but it is a niche. And if you have business to do, you may want to look beyond that niche. There have been

There have been  It also highlights the dominance Google has in the Open Handset Alliance which might, longer-term, lead to assertions that Google is in fact using the open source road as a cover to push what is effectively an OS largely driven by them. I am not implying that it is and a healthy ecosystem with multiple strong is important in particular for the launch of a new OS in a space so full of powerful multi-nationals but there is a fine line to walk in order to get it right.

It also highlights the dominance Google has in the Open Handset Alliance which might, longer-term, lead to assertions that Google is in fact using the open source road as a cover to push what is effectively an OS largely driven by them. I am not implying that it is and a healthy ecosystem with multiple strong is important in particular for the launch of a new OS in a space so full of powerful multi-nationals but there is a fine line to walk in order to get it right. After many rumours and ominous statements that it was “reviewing its activities” Namco Bandai

After many rumours and ominous statements that it was “reviewing its activities” Namco Bandai  What is worrying is that this cements the oligopoly of games distribution in all major markets. EA Mobile, Gameloft occupy the top 2 slots very comfortably with Glu an equally comfortable but distant third. I-Play, Digital Chocolate, Real and Connect 2 Media are fighting for place and Xendex, Handy Games and a few others seek (and sometimes find) niches to prosper. THQ Wireless, Vivendi Games Mobile have departed. Player X found a new home under the mighty wings of Zed. And then? If the above companies all manage to maintain a healthy business, this might be enough; there are silverback gorillas in every market segment. If not though, this might become a

What is worrying is that this cements the oligopoly of games distribution in all major markets. EA Mobile, Gameloft occupy the top 2 slots very comfortably with Glu an equally comfortable but distant third. I-Play, Digital Chocolate, Real and Connect 2 Media are fighting for place and Xendex, Handy Games and a few others seek (and sometimes find) niches to prosper. THQ Wireless, Vivendi Games Mobile have departed. Player X found a new home under the mighty wings of Zed. And then? If the above companies all manage to maintain a healthy business, this might be enough; there are silverback gorillas in every market segment. If not though, this might become a  Now, let’s try to differentiate a little. Would you say the US have the lead in computer manufacturing? Well, probably not. IBM’s ThinkPads are Chinese, then there is Sony, Samsung, Toshiba, and there is HP and Dell. There is of course also Apple (“designed in California”). Does it matter at all where the hardware is from? No, not at all, and no one really cares anymore. And why not? Because hardware is basically a commodity, that is in a world where one does not actually see that much of the hardware because the interfaces are software-driven. And these are from Microsoft, etc.

Now, let’s try to differentiate a little. Would you say the US have the lead in computer manufacturing? Well, probably not. IBM’s ThinkPads are Chinese, then there is Sony, Samsung, Toshiba, and there is HP and Dell. There is of course also Apple (“designed in California”). Does it matter at all where the hardware is from? No, not at all, and no one really cares anymore. And why not? Because hardware is basically a commodity, that is in a world where one does not actually see that much of the hardware because the interfaces are software-driven. And these are from Microsoft, etc. The iPhone has changed a lot of things of course. However, American Idol arguably

The iPhone has changed a lot of things of course. However, American Idol arguably  One last word on Europe: distinct to what Mr Scoble appears to have in mind, Europe is not a country, and this is not meant to be sarcastic. Europe is a pile of little countries and in each of them a couple of carriers rule like little kings. It makes for an extremely complex (and, consequently, low-margin) playground to deploy services. The US (as well as some of the huge Asian countries) have the incredible opportunity to deploy applications and services in one language through less than a handful of carriers to hundreds of millions. No such thing in Europe.

One last word on Europe: distinct to what Mr Scoble appears to have in mind, Europe is not a country, and this is not meant to be sarcastic. Europe is a pile of little countries and in each of them a couple of carriers rule like little kings. It makes for an extremely complex (and, consequently, low-margin) playground to deploy services. The US (as well as some of the huge Asian countries) have the incredible opportunity to deploy applications and services in one language through less than a handful of carriers to hundreds of millions. No such thing in Europe. I hope, however, the US will catch up on this front sooner rather than later, too. Because of the size of the market and the aforementioned advantages, it would unleash incredible opportunities that would bring all of us fantastic new services and applications. And, Mr Scoble, it does not matter if these are 160 characters or polished web pages; it depends on what you want to do with it (as you, being one of the

I hope, however, the US will catch up on this front sooner rather than later, too. Because of the size of the market and the aforementioned advantages, it would unleash incredible opportunities that would bring all of us fantastic new services and applications. And, Mr Scoble, it does not matter if these are 160 characters or polished web pages; it depends on what you want to do with it (as you, being one of the