Microsoft has a central market place for Windows Mobile applications in the making. It is the latest (and maybe the last) of the big smartphone platform makers to come forth with such a model. And – with a probably already somewhat reflexive jab to its Cupertino nemesis (yes, Mr Gates’ children are not allowed iPods), it vowed to be more open to outside software developers.

Microsoft has a central market place for Windows Mobile applications in the making. It is the latest (and maybe the last) of the big smartphone platform makers to come forth with such a model. And – with a probably already somewhat reflexive jab to its Cupertino nemesis (yes, Mr Gates’ children are not allowed iPods), it vowed to be more open to outside software developers.

Apple is indeed not known for the most proactive approach to external partners but it does have a bit of a name for being a “good company”. Microsoft on the other hand is, rightly or wrongly, not really known for this. It would be a nice move. Other than that – also somewhat familiar – Microsoft’s store is said to be closely following Apple’s lead, even the revenue share (70% to developers) is apparently the same. The only difference would then be the openness. This is presumably being highlighted following a couple of

incidents where developers complained that Apple had not accepted their applications without giving them a good reason. If Microsoft were to make this bit better, it would constitute a significant improvement as it would save developers from spending money on application development only to see them canned.

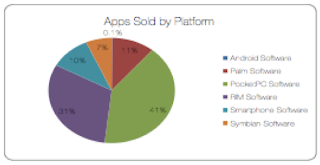

The rationale for Microsoft’s move is utterly simple: a) there are more Windows Mobile apps out than iPhone ones (20,000 they say). It is just a wee bit more difficult to find them, b) everyone else (RIM, Nokia, Android, hell, even Palm) does it, and c) Apple is insanely successful with it.

The big question that remains is if the integration of the store will be as seamless as Apple’s. The key differentiator is that Apple has managed (which no other OEM has so far) to impose a strictly regulated environment from end to end: its program has an easy entry (a few paragraphs with a click-through agreement), a fairly well-controlled development environment and a unified output (the store), which is the same anywhere in the world. Even the biggest OEMs have

struggled to impose anything even resembling this kind of control. Windows Mobile runs on a number of the tier-2 players (HTC) that have done the opposite to Apple: HTC willingly gives away its branding in favour of a carrier brand and is content to provide the hardware. Since it can be expected that at least the larger carriers will be keen to run app stores of their own, Microsoft will struggle more than Apple (which was a highly anticipated new market entrant with a tremendous brand message) to assert this type of dominance over carrier specs. The recent

rumours of lower Windows Mobile output won’t necessarily help either.

I would welcome a success from Microsoft; let Apple not grow overly content…

Microsoft has a central market place for Windows Mobile applications in the making. It is the latest (and maybe the last) of the big smartphone platform makers to come forth with such a model. And – with a probably already somewhat reflexive jab to its Cupertino nemesis (yes, Mr Gates’ children are not allowed iPods), it vowed to be more open to outside software developers.

Microsoft has a central market place for Windows Mobile applications in the making. It is the latest (and maybe the last) of the big smartphone platform makers to come forth with such a model. And – with a probably already somewhat reflexive jab to its Cupertino nemesis (yes, Mr Gates’ children are not allowed iPods), it vowed to be more open to outside software developers.![]()