I signed up for the pre-order of the Leap Motion controller ages ago. And, of course, it must arrive whilst I was on vacation… But, hey, it’s here now and since I was asked by a couple of friends to provide them with my thoughts, this is my first ever product review. A few words of caution though: I am not providing a fully-fledged review, just a few bits and bobs and my thoughts on the overall thing. For more traditional things, see e.g. here or here (consumer-focussed simple overview) or here (more in-depth technical).

I signed up for the pre-order of the Leap Motion controller ages ago. And, of course, it must arrive whilst I was on vacation… But, hey, it’s here now and since I was asked by a couple of friends to provide them with my thoughts, this is my first ever product review. A few words of caution though: I am not providing a fully-fledged review, just a few bits and bobs and my thoughts on the overall thing. For more traditional things, see e.g. here or here (consumer-focussed simple overview) or here (more in-depth technical).

Installation Environment

I installed it on my MacBook Pro (13” Retina, 3 GHz i7, 8GB RAM, 512GB SSD) running on the latest OS (at the time of writing, that’s 10.8.4). It comes with two cables, a long and a short one, which is a neat idea. Alas, I would actually have wanted a cordless one but the, I guess, it might be a wee bit early for some BlueTooth 4.0 magic, so I’ll let this pass. It does not come with a manual and whilst that is oh-so-valley-style, a “cheat sheet” for the various gestures might be a good idea: as it is such a completely novel interaction method, it would make peoples’ lives a lot easier if they could check back quickly in the old-fashioned style. I mean, you could do it hipster-infographic-style as a hat-tip to the Valley, could you not?

You plug in, are asked to go to a website and install the software. Simple.

The Start

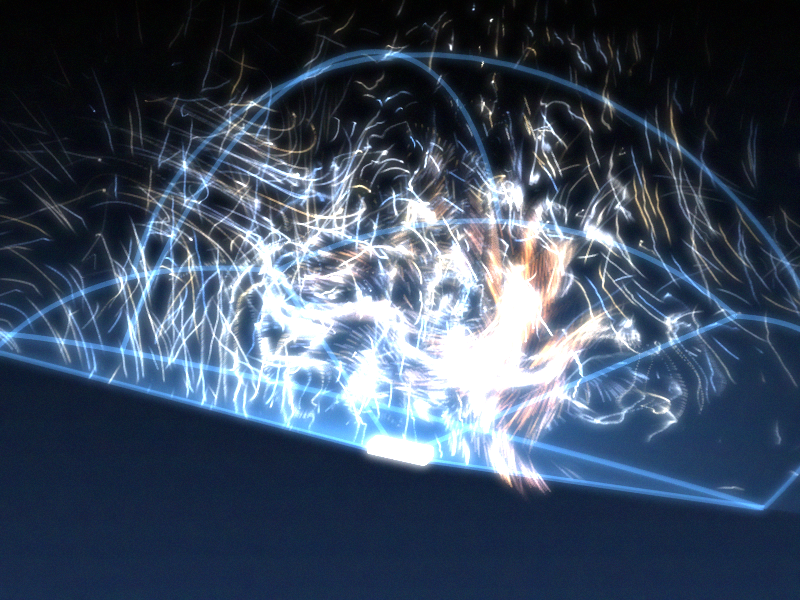

The first thing you do is go through an “orientation” programme, which is sheer beauty and gives you the first, well, orientation on what to do (and what not). This is the first bit where it shows you what it sees (in rough but pretty terms):

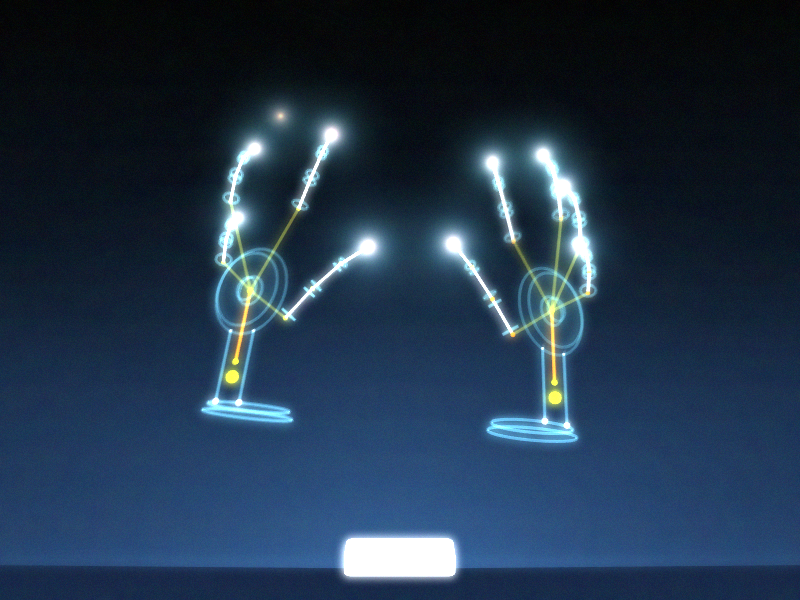

Then it shows you what it really sees (in more accurate and mechanical terms):

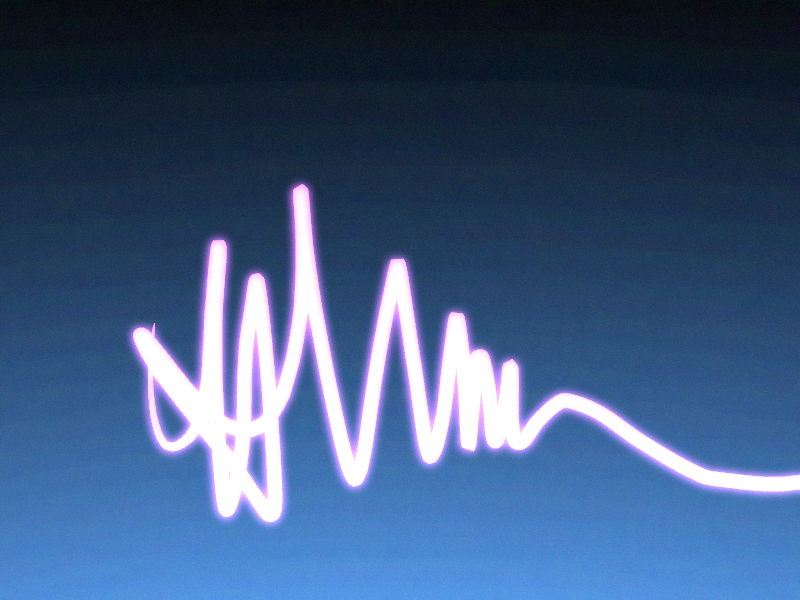

The rest is play. Here’s my son practicing his signature:

Using Leap Motion…

Then I started off. There are quite a few pretty cool apps available already (the company announced 1m downloads today, a mere 4 weeks after starting to ship to consumers). The New York Times app is nice (if practical). There are some sweet ones exploring molecules, etc. There are, alas, also some that don’t really work (yet). The usual shenanigans every new platform goes through. Anyway, I then downloaded the “Touchless for Mac” app, which turns the Leap controller into a navigation tool for your computer. And it works: It took me the best part of 20 minutes to actually get going nicely. I could open web pages, scroll through my Facebook feed, open links, play (and pause) video, etc. without too much struggle or stress. Latency is basically absent.

Mind you, this is not Minority Report if you are in the early stages of use (there is a “basic” and an “advanced” setting; I haven’t ventured beyond “basic” yet). But what would you expect? It is new, you have never used gesture controls in space (unless you’re Tom Cruise of course), so you will have to learn. I have little times for nay-sayers that already point out that it’ll fail because it is not perfect. It is a very impressive start!

My son (18, slightly geeky [and designy] aspiring Physicist and skateboard apparel entrepreneur) was, unsurprisingly, a lot faster than I in picking this up. It took him the best part of 5 minutes to successfully navigate around the parts that caused me some trial and error (small buttons, e.g. the “close window” one). BTW: Even my wife thinks is cool, and she hasn’t even seen Minority Report!

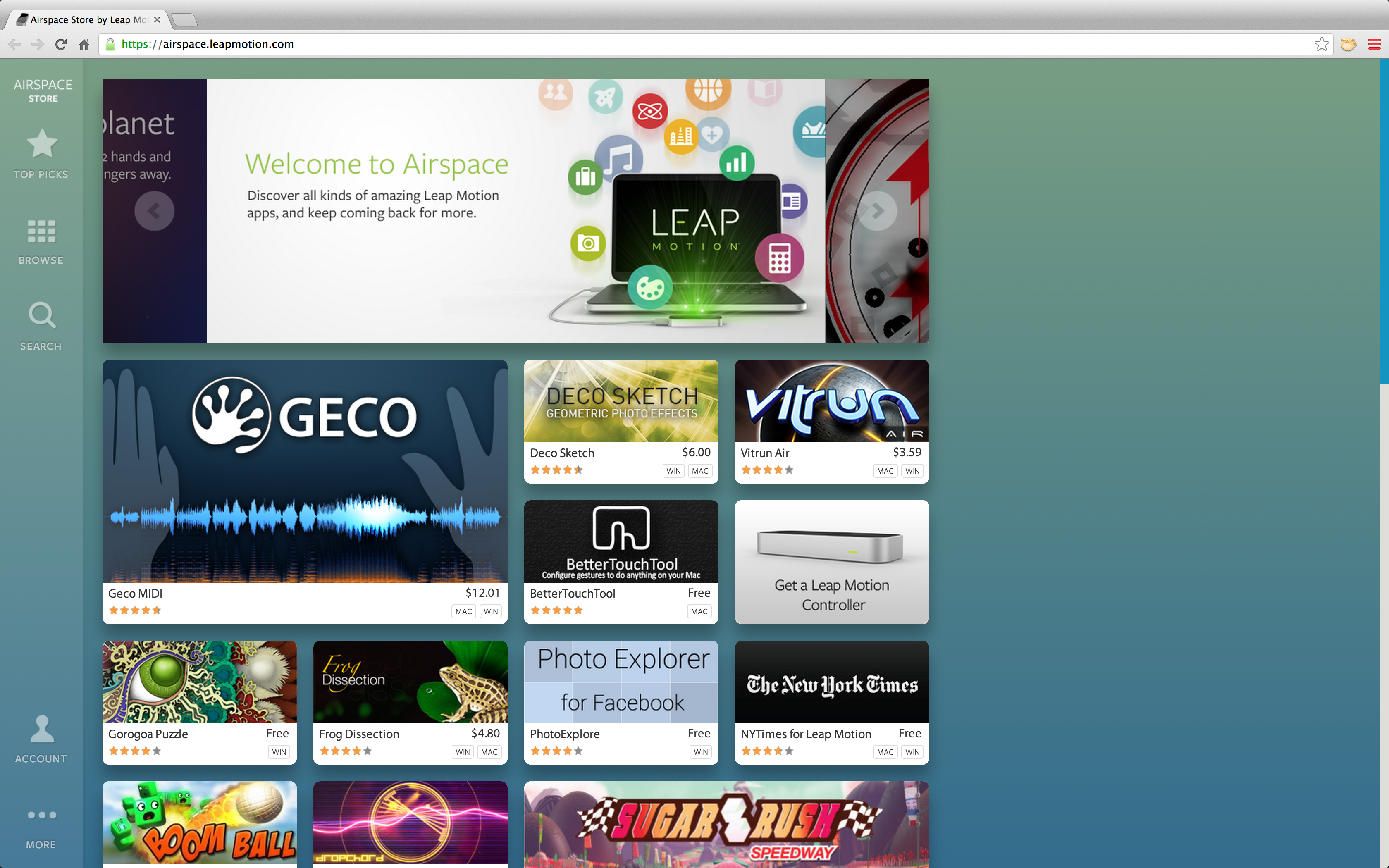

Apps, Apps, Apps…

In the year of the Lord (if you are so inclined) 2013, we all know that any device is only ever as useful as the applications that exist for it. And this is where the whole Leap experience delights and, erm, shows potential for growth at the same time: there are some apps out there already (and bear in mind that it’s a mere 4-5 weeks they are in the market only) that show you what can be done with this. And I would say it shows great promise! There are, however, also some absolute dogs (I won’t name and shame as I have no inclination of rubbishing brave developers that took an early leap [sic!] of faith to get behind a new platform).

User Interface

The biggest challenge is the bridge between today’s computer interfaces (I have yet to play around with it on Windows 8; need to “borrow” my daughter’s computer for that) are either mouse- or touch-centric. This is to say that they do not take into account the intrinsic constraints of gesture-based UX systems. That is to say: there is a natural constraint in how the Leap Motion can work with today’s computer systems. That, however, is (arguably) not the Leap Motion’s fault. The promises are huge as it removes artificial middlemen between the content and the user’s natural input mechanism (of which gesture is one). However, the full power of it will only come to fruition if paired with an OS interface that is designed for it, and this might – at least in the short term – be the snag: Leap doesn’t have that.

They have done a lot of things right though (the developer uptake is testament to that for a start) and it would be thrilling to see it being married to an interface that is actually built for it. It is not that hard, I think: Leap Motion’s own store shows (in a webpage) how to adapt a few things that make it very usable indeed.

Big buttons, clear borders between items, etc. make it a whole lot easier to navigate fluently and quickly using the gesture input. This is running in a present-day browser, so can’t be rocket science. There are already some convincing implementations of the Leap’s controls into live services: Google Earth as well as Nokia’s Here Maps already allow you to use the Leap Motion controller as an input device and that works really well!

One downside is the “jump” if you scroll: it sometimes just drops when you move your finger forward (a “click”), essentially misinterpreting what you want to do. This then can open another app (because it got “hooked” in the app tray below) or do some other stuff you didn’t really want it to do. Because of the above-mentioned challenge with small “close window” buttons, this is not a welcome distraction.

Another challenging piece is to use the Leap Motion in concert with keyboard and touchpad: because your fingers move in and/or near the “vision” of the controller, it sometimes interferes by e.g. re-setting your pointer to somewhere else on the screen, which is somewhat annoying. For everyday use, this is even fatal: if you always have to activate/de-activate and/or connect/dis-connect, you will probably not be using it at all once the early excitement has worn off. But let this not deter you from the concept: this last challenge could very easily be abolished would OEM incorporate the controller into an actual computer: the moment you use the keyboard, the Leap controller would simply be “muted” (or something a whole lot smarter than that). None of the constraints are flaws of the technology but merely on how it interacts with today’s commercially available hardware. If you allow a crude comparison: a Lamborghini Aventador would not have been much fun on cart tracks in the 19th century: the device would simply not interact that well with its incumbent environment. Alas, we are not 150 years apart here: all components exist and could work hand in glove (I know, tacky pun) with each other with only very few tweaks.

And Onwards!

And this is where it gets exciting: imagine a controller like this for navigation tasks, voice, etc for things like text input and couple this with anything from Google Glass to Pico Projectors (fairly sure Wikipedia needs an update here) to proximity-aware screens in your environment (you walk into your home, it all comes alive on a 50” screen whereas it would happily play on your Google Glass-type screen whilst you are on your way from work in the metro/tube/bus/subway). You have the freedom to choose and use natural inputs (voice, gestures) depending on what makes most sense for the task at hand. Doable? Absolutely. Close? I suspect so!

Conclusion?

So what do I think? After the above, you’d appreciate this is only an interim conclusion. In principle: I love it! How often will I use it in the next six months or so? Not very much, I guess, as it still doesn’t have the critical bits I particularly need (I am one of the boring MS Office/Keynote/Chrome types). But what can it (and/or competitors, successors, subsequent evolutions of it) do? Enormous things!

Recently, previously civilized and subtle top executives of the world’s big mobile handset makers took the gloves off and became, well, a little more outspoken. What sticks from this is, of course, always only the most figurative snippets. Because all of these esteemed people have the most vested of all vested interests, their statements tend to distort reality a little. And because of that, we have increasingly lively debates at hand. But, alas, these debates may not necessarily lead to enlightenment.

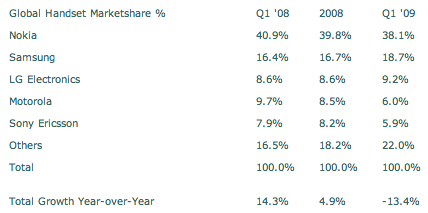

Recently, previously civilized and subtle top executives of the world’s big mobile handset makers took the gloves off and became, well, a little more outspoken. What sticks from this is, of course, always only the most figurative snippets. Because all of these esteemed people have the most vested of all vested interests, their statements tend to distort reality a little. And because of that, we have increasingly lively debates at hand. But, alas, these debates may not necessarily lead to enlightenment. When one looks at the world map and then listens to the good folks cited above (and others), it appears that there is not one but many little worlds out there. Nokia is sitting high and dry in overall handset rankings with over 35% market share across all handsets. It is

When one looks at the world map and then listens to the good folks cited above (and others), it appears that there is not one but many little worlds out there. Nokia is sitting high and dry in overall handset rankings with over 35% market share across all handsets. It is  The situation is a little more serious for other single-segment OEM. RIM used to live off the fat of the land in the enterprise sector. And it continues to thrive there. In recent years, it has seen a huge upswing amongst kids – because of the now almost legendary BBM (Blackberry Messenger for the uninformed). However, can you successfully build or expand on a single feature? And then on one that could really also be mimicked, worked around or substituted by something similar? Tricky.

The situation is a little more serious for other single-segment OEM. RIM used to live off the fat of the land in the enterprise sector. And it continues to thrive there. In recent years, it has seen a huge upswing amongst kids – because of the now almost legendary BBM (Blackberry Messenger for the uninformed). However, can you successfully build or expand on a single feature? And then on one that could really also be mimicked, worked around or substituted by something similar? Tricky. All this does of course not bother Android (and perhaps also Microsoft’s Windows Phone 7) as they have the advantage of being able to bringing many weapons to the battlefield. Android’s huge advantage is one of price due to its open-source nature: For Windows Phone 7, you need to pay a software license. Android is – basically – free. Both have multiple OEM that fight their corner though. Which is, or at least can be, good. Google will not really care if the next killer phone is produced by HTC or Motorola or Sony Ericsson (or Foxconn directly for that matter).

All this does of course not bother Android (and perhaps also Microsoft’s Windows Phone 7) as they have the advantage of being able to bringing many weapons to the battlefield. Android’s huge advantage is one of price due to its open-source nature: For Windows Phone 7, you need to pay a software license. Android is – basically – free. Both have multiple OEM that fight their corner though. Which is, or at least can be, good. Google will not really care if the next killer phone is produced by HTC or Motorola or Sony Ericsson (or Foxconn directly for that matter). Does this matter much to Apple? Possibly not. The margin discussion will, in all likelihood, be one that Apple execs will happily take. They will look better at it. However, will it manage to break the old Mac vs. PC pattern? Probably not. However, Apple’s position looks much brighter than it did in the decades of 5% OS-share mediocrity. The company has perfected the hardware-software-service-sex-appeal equation, which looks likely to cement a much more comfortable niche for it (just have a look at its market cap).

Does this matter much to Apple? Possibly not. The margin discussion will, in all likelihood, be one that Apple execs will happily take. They will look better at it. However, will it manage to break the old Mac vs. PC pattern? Probably not. However, Apple’s position looks much brighter than it did in the decades of 5% OS-share mediocrity. The company has perfected the hardware-software-service-sex-appeal equation, which looks likely to cement a much more comfortable niche for it (just have a look at its market cap). First, Samsung

First, Samsung  Symbian of course boasts a still very impressive number of legacy devices, and it will therefore be here for a while. However, what does the long-term outlook look like? Android, LiMo, etc all “boast” a nimbler, more agile set-up, allowing for faster development and, arguably, better user experience. This is not necessarily Symbian’s fault (it carries with it its legacy around) but it makes it that much harder for it to reinvent itself.

Symbian of course boasts a still very impressive number of legacy devices, and it will therefore be here for a while. However, what does the long-term outlook look like? Android, LiMo, etc all “boast” a nimbler, more agile set-up, allowing for faster development and, arguably, better user experience. This is not necessarily Symbian’s fault (it carries with it its legacy around) but it makes it that much harder for it to reinvent itself.

No, this post will not muse over Google’s new Wave

No, this post will not muse over Google’s new Wave