Every now and again, war breaks out on the web. Or, rather, a full-on discourse of learned scholars on the world at large or, in our case, mobile in particular. This week saw one such blog fights and, no, I am not talking about Wikileaks. The formidable Robert Scoble (he of recent European ignorance but, hey, he is American after all… ;-)) and Tomi Ahonen (Rat-Hat of Forum Oxford and a certain [but not blind!] Nokia-fandom but, hey, he might live in HK but he is a Fin… ;-)) brought it on about the fall or not of Nokia.

Every now and again, war breaks out on the web. Or, rather, a full-on discourse of learned scholars on the world at large or, in our case, mobile in particular. This week saw one such blog fights and, no, I am not talking about Wikileaks. The formidable Robert Scoble (he of recent European ignorance but, hey, he is American after all… ;-)) and Tomi Ahonen (Rat-Hat of Forum Oxford and a certain [but not blind!] Nokia-fandom but, hey, he might live in HK but he is a Fin… ;-)) brought it on about the fall or not of Nokia.

It started with one of Tomi’s long, long posts on “Some Symbian Sanity” to which Scoble responded “Why Nokia is Still Doomed“. Because he referenced Tomi, he – if you know him, you’d say “of course” – responded with another long post defending Nokia’s smartphone strategy and execution. You should think Tomi has the harder corner to fight, right? 😉

Let me briefly summarise the warring parties’ viewpoints. I will then offer my own take on this to decide who’s right.

Scoble’s Opinion

Scoble first, he, never shy for words, delivered a swift and damning verdict on Nokia: Illustrated ventured Eastwards again to LeWeb last week and took stock of Europe’s smartphone pulse.he reckons that Nokia is dead because none of his friends has one or, if they do, they don’t like it. People pile up in Apple stores and wax lyrical about the apps they find on the iPhone and iPod Touch. Nokia is arrogant rather than cognisant of its shortfalls and he has not recently heard of a strategy. The people (and/or Scoble’s friends) love iPhone. Case closed.

Scoble first, he, never shy for words, delivered a swift and damning verdict on Nokia: Illustrated ventured Eastwards again to LeWeb last week and took stock of Europe’s smartphone pulse.he reckons that Nokia is dead because none of his friends has one or, if they do, they don’t like it. People pile up in Apple stores and wax lyrical about the apps they find on the iPhone and iPod Touch. Nokia is arrogant rather than cognisant of its shortfalls and he has not recently heard of a strategy. The people (and/or Scoble’s friends) love iPhone. Case closed.

Tomi’s Original and Scoble Riposte

It’s always a little more difficult to summarise Tomi’s posts as he doesn’t do quick ones. Who knows him is aware that he is a big fan of numbers, of big numbers, in fact. And this is why he hangs on to Nokia: because, you know, their numbers are big! His original post goes – very, very simplified – like this: he sets off to compare Apple with Porsche (as opposed to, say VW). He didn’t reference my recent post on this (tut, tut, Tomi) but the gist is the same: Nokia doesn’t only do Porsche, it does everything from VW Polo (or Chevy Matiz, Kia something or other) to Bentley (well, maybe that not anymore unless you count Vertu in). Its competitor is therefore not Ferrari but Toyota or – in the mobile world – not Appele but Samsung.

It’s always a little more difficult to summarise Tomi’s posts as he doesn’t do quick ones. Who knows him is aware that he is a big fan of numbers, of big numbers, in fact. And this is why he hangs on to Nokia: because, you know, their numbers are big! His original post goes – very, very simplified – like this: he sets off to compare Apple with Porsche (as opposed to, say VW). He didn’t reference my recent post on this (tut, tut, Tomi) but the gist is the same: Nokia doesn’t only do Porsche, it does everything from VW Polo (or Chevy Matiz, Kia something or other) to Bentley (well, maybe that not anymore unless you count Vertu in). Its competitor is therefore not Ferrari but Toyota or – in the mobile world – not Appele but Samsung.

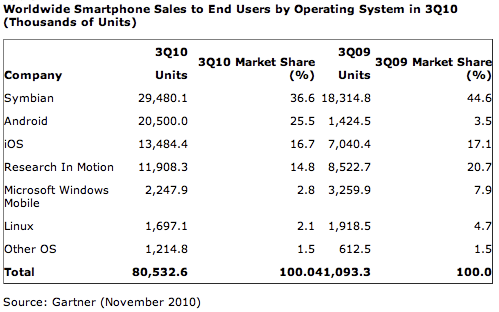

He then dives into Nokia’s strategy. And this is when it goes a little, well, foggy. Symbian being miles ahead (yes), Symbian kicking a** today with the N8 (erm, no), Apple’s original (sic!) iOS failing when it comes to phone features (well, yes, maybe, but who is using the “original” iOS today? Or the original Symbian for that matter?). And then he goes on to run the numbers. Now, according to him (and I didn’t check the numbers) Nokia + Japan = 45% smartphone market share for Symbian in 2009 (down a whopping 11% even by his count from 2006). Now, here’s where the questions start (more later). Then onwards to the mass market (more later). And, Tomi (being the very smart man and learned scholar he is) recognises Symbian might be a bit old and clunky and (rightly and unsurprisingly) pits MeeGo against this: new, open, Linux-based, etc. A winner, right? (more later). Therefore, Tomi heralds Nokia as being the perfect example in moving from “dumbphone” to smartphone.

Following Scoble’s burst of opinion as per above, Tomi reverted with more (as he does). I’ll skip through most of it. However, one point he raises is that the US is only 8% of the global market (true). It is though higher on smartphone consumption and (one language, one currency and all) provides a cool launchpad in a rich (yes, still) market. And Nokia is the Robbie Williams of the mobile world when it comes to the US: never managed to break it! He goes on to answer the “Nokia’s not cool” argument and refers to eco-friendly. Well, Tomi, that’s a little lame. Face it: Nokia lost its cool. Period. No argument! Apps? Yes, I know Ovi is catching up but, come on, the app store changed the bloody ecosystem (Nokia had about 4 iterations pre-Ovi who all miserably failed; Apple provided the paradigm-shift – face it).

Who is right?

The weird thing is that they both are (or, more controversially, neither is)!

And here’s why (hint: Tomi did get it right but then got carried away on the Finnish ticket): Tomi nailed it in his first post when he compared Apple to Porsche. Apple is not (or not yet?) competing with the Volkswagens and Toyotas of the mobile world. Now: in the automotive world, Porsche failed with the big coup (but, let’s remember, only just!). Apple might yet pull it off. The starting point is not dissimilar: super-high margins, a very comfortable lead in the luxury segment and loads of cash. Porsche over-reached (driven by a perhaps over-zealous ruler). Apple might, well…

And here’s why (hint: Tomi did get it right but then got carried away on the Finnish ticket): Tomi nailed it in his first post when he compared Apple to Porsche. Apple is not (or not yet?) competing with the Volkswagens and Toyotas of the mobile world. Now: in the automotive world, Porsche failed with the big coup (but, let’s remember, only just!). Apple might yet pull it off. The starting point is not dissimilar: super-high margins, a very comfortable lead in the luxury segment and loads of cash. Porsche over-reached (driven by a perhaps over-zealous ruler). Apple might, well…

Scoble looks at the US first and foremost. And it is – in spite of the many struggles – a formidable market still. And Apple made one of the most impressive market entries of all time! Now, will it be equally easy to capture China, India, Brazil, Russia, Indonesia, etc? I doubt it. Does Scoble see this? No.

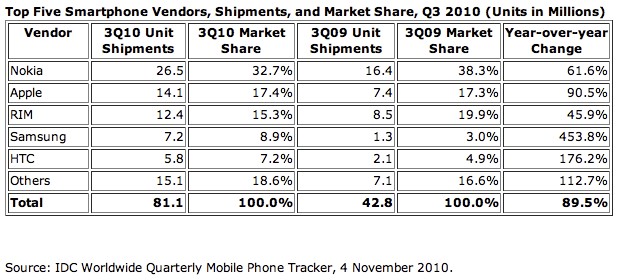

As to Tomi: you may want to count in the likes of Foxconn in the more formidable competitors of the mighty Finns. But that aside, yes, it’s mainly Samsung today. As a matter of fact, we need to start looking at handset (and OS) segments a little differently. Symbian might be a smartphone platform in the old definition but it does not (usually) stack up against Apple’s iOS or the slicker iterations of Google’s Android in the new world. This is why Nokia keeps losing market share in the high end rapidly (and loses market capitalization equally fast) and why Apple’s market cap is at an all time high! Will it win the war? No, not necessarily. And Nokia still has a shot. But the N8 was too little too late: hardware specs don’t count, the user experience does. And Nokia lost it on that front (compared to its up-market rivals).

So, folks, just re-read my post on Volkswagen and Porsche, will you? And settle your little tiff… 😉

You hear it often (most recently by

You hear it often (most recently by

Recently, previously civilized and subtle top executives of the world’s big mobile handset makers took the gloves off and became, well, a little more outspoken. What sticks from this is, of course, always only the most figurative snippets. Because all of these esteemed people have the most vested of all vested interests, their statements tend to distort reality a little. And because of that, we have increasingly lively debates at hand. But, alas, these debates may not necessarily lead to enlightenment.

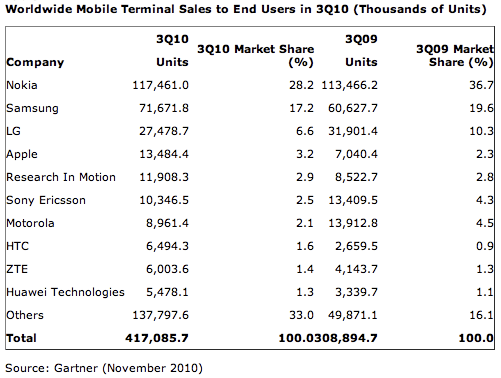

Recently, previously civilized and subtle top executives of the world’s big mobile handset makers took the gloves off and became, well, a little more outspoken. What sticks from this is, of course, always only the most figurative snippets. Because all of these esteemed people have the most vested of all vested interests, their statements tend to distort reality a little. And because of that, we have increasingly lively debates at hand. But, alas, these debates may not necessarily lead to enlightenment. When one looks at the world map and then listens to the good folks cited above (and others), it appears that there is not one but many little worlds out there. Nokia is sitting high and dry in overall handset rankings with over 35% market share across all handsets. It is

When one looks at the world map and then listens to the good folks cited above (and others), it appears that there is not one but many little worlds out there. Nokia is sitting high and dry in overall handset rankings with over 35% market share across all handsets. It is  The situation is a little more serious for other single-segment OEM. RIM used to live off the fat of the land in the enterprise sector. And it continues to thrive there. In recent years, it has seen a huge upswing amongst kids – because of the now almost legendary BBM (Blackberry Messenger for the uninformed). However, can you successfully build or expand on a single feature? And then on one that could really also be mimicked, worked around or substituted by something similar? Tricky.

The situation is a little more serious for other single-segment OEM. RIM used to live off the fat of the land in the enterprise sector. And it continues to thrive there. In recent years, it has seen a huge upswing amongst kids – because of the now almost legendary BBM (Blackberry Messenger for the uninformed). However, can you successfully build or expand on a single feature? And then on one that could really also be mimicked, worked around or substituted by something similar? Tricky. All this does of course not bother Android (and perhaps also Microsoft’s Windows Phone 7) as they have the advantage of being able to bringing many weapons to the battlefield. Android’s huge advantage is one of price due to its open-source nature: For Windows Phone 7, you need to pay a software license. Android is – basically – free. Both have multiple OEM that fight their corner though. Which is, or at least can be, good. Google will not really care if the next killer phone is produced by HTC or Motorola or Sony Ericsson (or Foxconn directly for that matter).

All this does of course not bother Android (and perhaps also Microsoft’s Windows Phone 7) as they have the advantage of being able to bringing many weapons to the battlefield. Android’s huge advantage is one of price due to its open-source nature: For Windows Phone 7, you need to pay a software license. Android is – basically – free. Both have multiple OEM that fight their corner though. Which is, or at least can be, good. Google will not really care if the next killer phone is produced by HTC or Motorola or Sony Ericsson (or Foxconn directly for that matter). Does this matter much to Apple? Possibly not. The margin discussion will, in all likelihood, be one that Apple execs will happily take. They will look better at it. However, will it manage to break the old Mac vs. PC pattern? Probably not. However, Apple’s position looks much brighter than it did in the decades of 5% OS-share mediocrity. The company has perfected the hardware-software-service-sex-appeal equation, which looks likely to cement a much more comfortable niche for it (just have a look at its market cap).

Does this matter much to Apple? Possibly not. The margin discussion will, in all likelihood, be one that Apple execs will happily take. They will look better at it. However, will it manage to break the old Mac vs. PC pattern? Probably not. However, Apple’s position looks much brighter than it did in the decades of 5% OS-share mediocrity. The company has perfected the hardware-software-service-sex-appeal equation, which looks likely to cement a much more comfortable niche for it (just have a look at its market cap). I have been dealing with movie and TV licenses for longer than I care to remember, and the pattern (with few exceptions) always was the same: the licensor comes to you saying that, because they are offering you (the publisher) a well-known movie/TV/entertainment property that everyone and their dog are fans of, you should pay them a healthy amount of money (either up-front or as a minimum guarantee against revenues) for them to grant you that license. This means that the publisher starts at a point of significant loss: a six-figure guarantee (and I’ve seen larger ones, too), six-figure production costs and little mitigating the risk that the title might totally tank.

I have been dealing with movie and TV licenses for longer than I care to remember, and the pattern (with few exceptions) always was the same: the licensor comes to you saying that, because they are offering you (the publisher) a well-known movie/TV/entertainment property that everyone and their dog are fans of, you should pay them a healthy amount of money (either up-front or as a minimum guarantee against revenues) for them to grant you that license. This means that the publisher starts at a point of significant loss: a six-figure guarantee (and I’ve seen larger ones, too), six-figure production costs and little mitigating the risk that the title might totally tank.